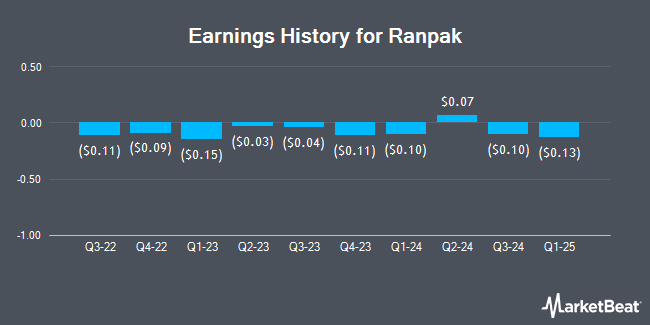

Ranpak (NYSE:PACK - Get Free Report) is expected to be announcing its Q1 2025 earnings results before the market opens on Thursday, May 1st. Analysts expect the company to announce earnings of ($0.04) per share and revenue of $90.56 million for the quarter.

Ranpak Stock Performance

Shares of NYSE PACK traded up $0.02 during trading hours on Friday, reaching $4.15. 504,082 shares of the stock were exchanged, compared to its average volume of 422,966. The firm has a market capitalization of $346.56 million, a price-to-earnings ratio of -17.27 and a beta of 2.70. The stock's fifty day simple moving average is $5.27 and its 200 day simple moving average is $6.36. The company has a debt-to-equity ratio of 0.71, a quick ratio of 2.01 and a current ratio of 2.36. Ranpak has a 52 week low of $3.38 and a 52 week high of $9.04.

Ranpak Company Profile

(

Get Free Report)

Ranpak Holdings Corp., together with its subsidiaries, provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia. The company offers protective packaging solutions, such as void-fill protective systems that convert paper to fill empty spaces in secondary packages and protect objects under the FillPak brand; cushioning protective systems, which convert paper into cushioning pads under the PadPak brand; and wrapping protective systems that create pads or paper mesh to wrap and protect fragile items, as well as to line boxes and provide separation when shipping various objects under the WrapPak, Geami, and ReadyRoll brands, as well as cold chain products, which are used to provide insulation for goods.

Featured Articles

Before you consider Ranpak, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ranpak wasn't on the list.

While Ranpak currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.