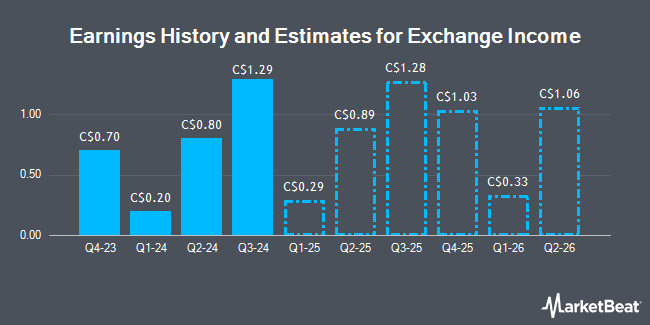

Exchange Income Co. (TSE:EIF - Free Report) - Analysts at Raymond James issued their Q1 2025 EPS estimates for Exchange Income in a research report issued to clients and investors on Friday, February 28th. Raymond James analyst S. Hansen forecasts that the company will post earnings per share of $0.38 for the quarter. The consensus estimate for Exchange Income's current full-year earnings is $4.00 per share. Raymond James also issued estimates for Exchange Income's Q2 2025 earnings at $0.95 EPS, Q3 2025 earnings at $1.32 EPS, Q4 2025 earnings at $0.92 EPS, FY2025 earnings at $3.56 EPS and FY2026 earnings at $3.76 EPS.

EIF has been the topic of a number of other reports. Royal Bank of Canada lifted their price target on shares of Exchange Income from C$65.00 to C$71.00 in a research report on Thursday, November 14th. Scotiabank reduced their price target on shares of Exchange Income from C$65.00 to C$64.00 in a research report on Friday, February 28th. CIBC lifted their price target on shares of Exchange Income from C$66.00 to C$69.00 in a research report on Wednesday, December 4th. National Bankshares lifted their price target on shares of Exchange Income from C$61.00 to C$68.00 in a research report on Monday, November 11th. Finally, Paradigm Capital set a C$69.00 price target on shares of Exchange Income and gave the stock a "buy" rating in a research report on Thursday, January 30th. Six equities research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, Exchange Income has an average rating of "Buy" and a consensus target price of C$69.00.

View Our Latest Research Report on EIF

Exchange Income Trading Down 1.4 %

Shares of TSE EIF traded down C$0.71 during midday trading on Monday, reaching C$50.34. 139,615 shares of the stock were exchanged, compared to its average volume of 115,056. The business has a 50-day simple moving average of C$54.57 and a two-hundred day simple moving average of C$53.69. The company has a market capitalization of C$2.51 billion, a price-to-earnings ratio of 19.72, a P/E/G ratio of 1.42 and a beta of 2.04. Exchange Income has a 12 month low of C$43.08 and a 12 month high of C$59.32. The company has a debt-to-equity ratio of 173.72, a current ratio of 1.76 and a quick ratio of 1.13.

Insider Buying and Selling

In other Exchange Income news, Director Michael Pyle purchased 4,000 shares of the stock in a transaction on Friday, February 28th. The shares were purchased at an average cost of C$50.26 per share, for a total transaction of C$201,052.00. Also, Director Edward Warkentin purchased 1,011 shares of the stock in a transaction on Tuesday, March 4th. The stock was acquired at an average price of C$49.54 per share, for a total transaction of C$50,087.97. Insiders have purchased a total of 5,366 shares of company stock worth $269,503 over the last ninety days. Company insiders own 6.44% of the company's stock.

Exchange Income Company Profile

(

Get Free Report)

Exchange Income Corporation, together with its subsidiaries, engages in aerospace and aviation services and equipment, and manufacturing businesses worldwide. The company Aerospace & Aviation, and Manufacturing segments. The Aerospace & Aviation segment offers fixed wing and rotary wing, medevac, passenger, charter, freight, and auxiliary services; and operates two flight schools and trains pilots.

Read More

Before you consider Exchange Income, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exchange Income wasn't on the list.

While Exchange Income currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.