Raymond James Financial Inc. purchased a new position in Azenta, Inc. (NASDAQ:AZTA - Free Report) during the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund purchased 46,612 shares of the company's stock, valued at approximately $2,331,000. Raymond James Financial Inc. owned 0.10% of Azenta at the end of the most recent quarter.

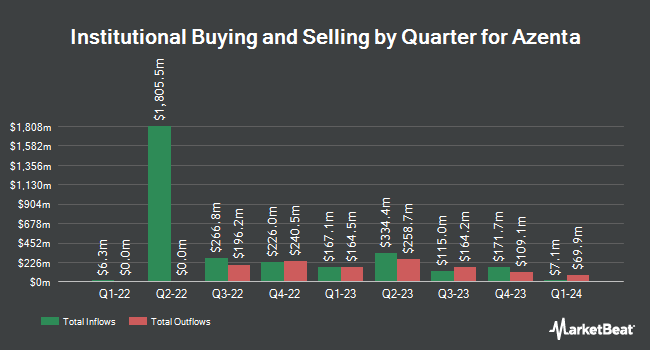

Several other institutional investors and hedge funds have also bought and sold shares of AZTA. Conestoga Capital Advisors LLC grew its stake in shares of Azenta by 65.0% during the 4th quarter. Conestoga Capital Advisors LLC now owns 1,577,881 shares of the company's stock worth $78,894,000 after acquiring an additional 621,830 shares during the period. Principal Financial Group Inc. lifted its position in shares of Azenta by 94.4% during the fourth quarter. Principal Financial Group Inc. now owns 221,083 shares of the company's stock worth $11,054,000 after acquiring an additional 107,339 shares in the last quarter. New York State Common Retirement Fund boosted its holdings in shares of Azenta by 41.0% in the fourth quarter. New York State Common Retirement Fund now owns 265,983 shares of the company's stock worth $13,299,000 after acquiring an additional 77,409 shares during the period. Peregrine Capital Management LLC boosted its holdings in shares of Azenta by 53.6% in the fourth quarter. Peregrine Capital Management LLC now owns 149,377 shares of the company's stock worth $7,469,000 after acquiring an additional 52,120 shares during the period. Finally, Charles Schwab Investment Management Inc. grew its position in shares of Azenta by 11.6% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 461,603 shares of the company's stock valued at $23,080,000 after purchasing an additional 48,064 shares in the last quarter. 99.08% of the stock is owned by institutional investors.

Azenta Trading Up 3.8 %

NASDAQ AZTA traded up $1.29 during trading on Wednesday, hitting $35.41. The company had a trading volume of 557,827 shares, compared to its average volume of 609,294. The company's fifty day moving average is $43.98 and its 200-day moving average is $46.01. Azenta, Inc. has a one year low of $33.33 and a one year high of $63.58. The company has a market cap of $1.62 billion, a price-to-earnings ratio of -11.88 and a beta of 1.52.

Azenta (NASDAQ:AZTA - Get Free Report) last released its quarterly earnings results on Wednesday, February 5th. The company reported $0.08 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.05 by $0.03. Azenta had a negative net margin of 24.91% and a positive return on equity of 1.25%. As a group, equities analysts anticipate that Azenta, Inc. will post 0.53 EPS for the current year.

Analyst Ratings Changes

AZTA has been the subject of several recent analyst reports. Stephens reaffirmed an "overweight" rating and set a $60.00 price objective on shares of Azenta in a research note on Thursday, January 2nd. TD Cowen raised Azenta to a "hold" rating in a research note on Thursday, February 27th. Evercore ISI boosted their target price on Azenta from $50.00 to $52.00 and gave the stock an "in-line" rating in a research report on Thursday, February 6th. Finally, Needham & Company LLC raised their price target on Azenta from $55.00 to $59.00 and gave the company a "buy" rating in a report on Thursday, February 6th. Three research analysts have rated the stock with a hold rating and two have issued a buy rating to the company's stock. Based on data from MarketBeat, the company has an average rating of "Hold" and an average target price of $58.75.

Get Our Latest Stock Report on Azenta

Azenta Company Profile

(

Free Report)

Azenta, Inc provides biological and chemical compound sample exploration and management solutions for the life sciences market in North America, Africa, China, the United Kingdom, rest of Europe, the Asia Pacific, and internationally. The company operates in two reportable segments, Life Sciences Products and Life Sciences Services.

Featured Stories

Before you consider Azenta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Azenta wasn't on the list.

While Azenta currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.