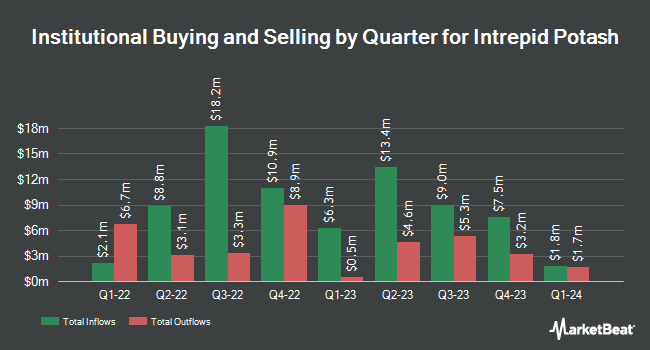

Raymond James Financial Inc. bought a new position in Intrepid Potash, Inc. (NYSE:IPI - Free Report) in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 46,901 shares of the basic materials company's stock, valued at approximately $1,028,000. Raymond James Financial Inc. owned approximately 0.35% of Intrepid Potash as of its most recent SEC filing.

Several other hedge funds and other institutional investors also recently modified their holdings of IPI. SG Americas Securities LLC increased its holdings in shares of Intrepid Potash by 14.0% in the fourth quarter. SG Americas Securities LLC now owns 6,743 shares of the basic materials company's stock worth $148,000 after purchasing an additional 830 shares during the period. Goehring & Rozencwajg Associates LLC lifted its stake in Intrepid Potash by 0.6% in the fourth quarter. Goehring & Rozencwajg Associates LLC now owns 209,362 shares of the basic materials company's stock worth $4,803,000 after acquiring an additional 1,272 shares during the period. State Street Corp increased its position in Intrepid Potash by 0.6% during the 3rd quarter. State Street Corp now owns 227,169 shares of the basic materials company's stock valued at $5,452,000 after purchasing an additional 1,402 shares during the period. R Squared Ltd purchased a new stake in shares of Intrepid Potash in the 4th quarter worth about $38,000. Finally, Geode Capital Management LLC boosted its position in Intrepid Potash by 0.8% during the 3rd quarter. Geode Capital Management LLC now owns 231,594 shares of the basic materials company's stock valued at $5,560,000 after acquiring an additional 1,732 shares in the last quarter. Institutional investors own 56.13% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have commented on IPI shares. StockNews.com lowered Intrepid Potash from a "hold" rating to a "sell" rating in a report on Thursday, March 27th. UBS Group reduced their price objective on Intrepid Potash from $21.00 to $20.00 and set a "sell" rating for the company in a research report on Tuesday, March 4th.

Read Our Latest Research Report on Intrepid Potash

Intrepid Potash Trading Down 2.4 %

IPI stock traded down $0.62 during midday trading on Tuesday, reaching $24.76. 204,882 shares of the company's stock traded hands, compared to its average volume of 105,325. The stock's 50-day moving average is $26.81 and its 200 day moving average is $25.70. The stock has a market cap of $327.48 million, a P/E ratio of -7.39 and a beta of 1.78. Intrepid Potash, Inc. has a 52-week low of $18.83 and a 52-week high of $31.29.

Intrepid Potash (NYSE:IPI - Get Free Report) last announced its earnings results on Monday, March 3rd. The basic materials company reported ($0.11) EPS for the quarter, missing analysts' consensus estimates of ($0.05) by ($0.06). Intrepid Potash had a negative return on equity of 1.32% and a negative net margin of 16.86%. The company had revenue of $55.80 million during the quarter, compared to the consensus estimate of $50.35 million. During the same period in the prior year, the business posted ($0.41) earnings per share. As a group, research analysts expect that Intrepid Potash, Inc. will post -0.17 EPS for the current fiscal year.

Insiders Place Their Bets

In related news, major shareholder Robert P. Jornayvaz III sold 8,984 shares of the company's stock in a transaction on Wednesday, March 26th. The shares were sold at an average price of $30.56, for a total value of $274,551.04. Following the completion of the transaction, the insider now owns 1,105,545 shares of the company's stock, valued at approximately $33,785,455.20. This represents a 0.81 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. In the last 90 days, insiders have sold 227,822 shares of company stock worth $6,168,606. Company insiders own 18.00% of the company's stock.

Intrepid Potash Company Profile

(

Free Report)

Intrepid Potash, Inc, together with its subsidiaries, engages in the extraction and production of the potash in the United States and internationally. It operates through three segments: Potash, Trio, and Oilfield Solutions. The company offers muriate of potash for various markets, such as agricultural market as a fertilizer input; the industrial market as a component in drilling and fracturing fluids for oil and gas wells, as well as an input to other industrial processes; and the animal feed market as a nutrient supplement.

Further Reading

Before you consider Intrepid Potash, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intrepid Potash wasn't on the list.

While Intrepid Potash currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.