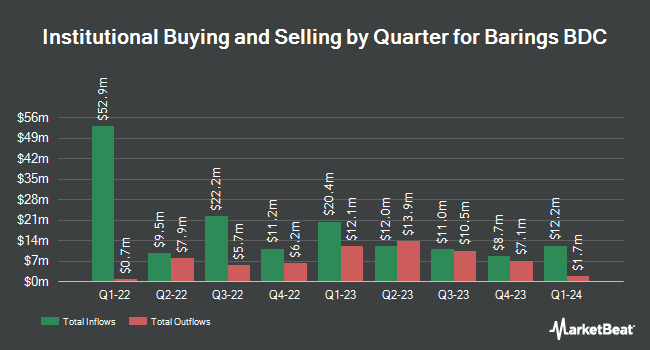

Raymond James Financial Inc. acquired a new stake in shares of Barings BDC, Inc. (NYSE:BBDC - Free Report) during the 4th quarter, according to its most recent 13F filing with the SEC. The firm acquired 929,089 shares of the company's stock, valued at approximately $8,891,000. Raymond James Financial Inc. owned approximately 0.88% of Barings BDC at the end of the most recent quarter.

A number of other hedge funds have also recently bought and sold shares of the company. Stifel Financial Corp increased its position in shares of Barings BDC by 1.6% during the third quarter. Stifel Financial Corp now owns 64,110 shares of the company's stock valued at $628,000 after acquiring an additional 1,017 shares during the last quarter. Koshinski Asset Management Inc. increased its position in shares of Barings BDC by 2.8% during the 4th quarter. Koshinski Asset Management Inc. now owns 47,158 shares of the company's stock valued at $451,000 after purchasing an additional 1,282 shares during the last quarter. Steward Partners Investment Advisory LLC raised its stake in shares of Barings BDC by 4.1% during the 4th quarter. Steward Partners Investment Advisory LLC now owns 39,478 shares of the company's stock worth $378,000 after purchasing an additional 1,565 shares during the period. Stephens Inc. AR boosted its holdings in shares of Barings BDC by 11.2% in the 4th quarter. Stephens Inc. AR now owns 19,133 shares of the company's stock worth $183,000 after buying an additional 1,930 shares during the last quarter. Finally, JPMorgan Chase & Co. boosted its holdings in shares of Barings BDC by 393.7% in the 3rd quarter. JPMorgan Chase & Co. now owns 2,582 shares of the company's stock worth $25,000 after buying an additional 2,059 shares during the last quarter. 44.09% of the stock is owned by hedge funds and other institutional investors.

Barings BDC Stock Performance

NYSE BBDC traded up $0.06 during trading hours on Tuesday, reaching $9.64. 374,728 shares of the company were exchanged, compared to its average volume of 432,850. The company has a quick ratio of 0.14, a current ratio of 0.14 and a debt-to-equity ratio of 0.37. The stock has a market capitalization of $1.02 billion, a P/E ratio of 9.27 and a beta of 0.66. Barings BDC, Inc. has a 1 year low of $8.95 and a 1 year high of $10.85. The business's 50 day simple moving average is $9.94 and its 200-day simple moving average is $9.83.

Barings BDC (NYSE:BBDC - Get Free Report) last posted its quarterly earnings results on Thursday, February 20th. The company reported $0.28 EPS for the quarter, missing analysts' consensus estimates of $0.29 by ($0.01). Barings BDC had a return on equity of 10.94% and a net margin of 38.54%. The company had revenue of $70.63 million during the quarter, compared to the consensus estimate of $69.35 million. On average, equities research analysts expect that Barings BDC, Inc. will post 1.13 earnings per share for the current year.

Barings BDC Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Wednesday, March 12th. Stockholders of record on Wednesday, March 5th were given a dividend of $0.26 per share. The ex-dividend date of this dividend was Wednesday, March 5th. This represents a $1.04 dividend on an annualized basis and a dividend yield of 10.79%. Barings BDC's dividend payout ratio is presently 100.00%.

Barings BDC Profile

(

Free Report)

Barings BDC, Inc is a publicly traded, externally managed investment company that has elected to be treated as a business development company under the Investment Company Act of 1940. It seeks to invest primarily in senior secured loans, first lien debt, unitranche, second lien debt, subordinated debt, equity co-investments and senior secured private debt investments in private middle-market companies that operate across a wide range of industries.

Recommended Stories

Before you consider Barings BDC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barings BDC wasn't on the list.

While Barings BDC currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.