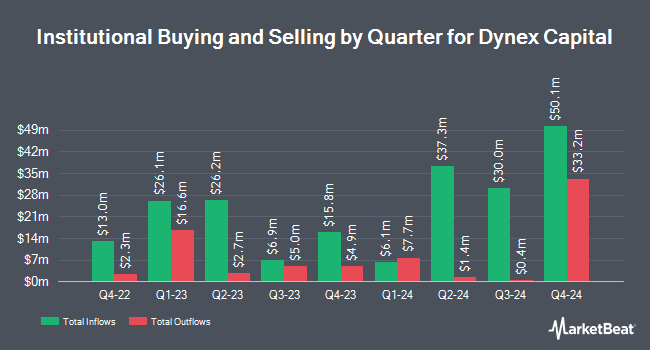

Raymond James Financial Inc. bought a new position in shares of Dynex Capital, Inc. (NYSE:DX - Free Report) in the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 119,383 shares of the real estate investment trust's stock, valued at approximately $1,510,000. Raymond James Financial Inc. owned about 0.15% of Dynex Capital at the end of the most recent reporting period.

A number of other large investors have also recently modified their holdings of the business. Geode Capital Management LLC increased its position in Dynex Capital by 17.5% during the 3rd quarter. Geode Capital Management LLC now owns 1,701,740 shares of the real estate investment trust's stock worth $21,718,000 after purchasing an additional 253,660 shares in the last quarter. Barclays PLC increased its holdings in shares of Dynex Capital by 833.2% during the third quarter. Barclays PLC now owns 218,853 shares of the real estate investment trust's stock worth $2,793,000 after buying an additional 195,400 shares in the last quarter. JPMorgan Chase & Co. lifted its stake in shares of Dynex Capital by 95.6% in the 3rd quarter. JPMorgan Chase & Co. now owns 390,100 shares of the real estate investment trust's stock valued at $4,978,000 after acquiring an additional 190,626 shares during the last quarter. Van ECK Associates Corp boosted its holdings in shares of Dynex Capital by 20.4% during the 4th quarter. Van ECK Associates Corp now owns 873,111 shares of the real estate investment trust's stock valued at $11,045,000 after acquiring an additional 148,235 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. grew its position in Dynex Capital by 20.1% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 610,120 shares of the real estate investment trust's stock worth $7,785,000 after acquiring an additional 101,948 shares during the last quarter. Institutional investors and hedge funds own 38.34% of the company's stock.

Dynex Capital Trading Down 4.4 %

Shares of DX traded down $0.57 during mid-day trading on Friday, reaching $12.14. 6,756,707 shares of the company were exchanged, compared to its average volume of 2,077,462. The business has a 50 day simple moving average of $13.60 and a two-hundred day simple moving average of $12.89. The company has a debt-to-equity ratio of 0.01, a quick ratio of 1.20 and a current ratio of 1.20. The stock has a market capitalization of $1.17 billion, a PE ratio of 8.26 and a beta of 1.14. Dynex Capital, Inc. has a 52 week low of $11.36 and a 52 week high of $14.52.

Dynex Capital (NYSE:DX - Get Free Report) last released its quarterly earnings results on Monday, January 27th. The real estate investment trust reported $0.10 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.38 by ($0.28). Dynex Capital had a negative return on equity of 2.24% and a net margin of 35.65%. On average, analysts predict that Dynex Capital, Inc. will post 1.94 earnings per share for the current fiscal year.

Dynex Capital Increases Dividend

The company also recently announced a monthly dividend, which was paid on Tuesday, April 1st. Investors of record on Monday, March 24th were issued a $0.17 dividend. This is a positive change from Dynex Capital's previous monthly dividend of $0.15. The ex-dividend date was Monday, March 24th. This represents a $2.04 annualized dividend and a yield of 16.81%. Dynex Capital's payout ratio is presently 138.78%.

Analysts Set New Price Targets

DX has been the subject of several research reports. StockNews.com upgraded Dynex Capital from a "sell" rating to a "hold" rating in a research report on Friday, January 31st. JMP Securities reiterated a "market perform" rating on shares of Dynex Capital in a research report on Thursday, January 23rd. Two investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $13.56.

Check Out Our Latest Stock Analysis on DX

About Dynex Capital

(

Free Report)

Dynex Capital, Inc, a mortgage real estate investment trust, invests in mortgage-backed securities (MBS) on a leveraged basis in the United States. It invests in agency and non-agency MBS consisting of residential MBS, commercial MBS (CMBS), and CMBS interest-only securities. Agency MBS have a guaranty of principal payment by an agency of the U.S.

Further Reading

Before you consider Dynex Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dynex Capital wasn't on the list.

While Dynex Capital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.