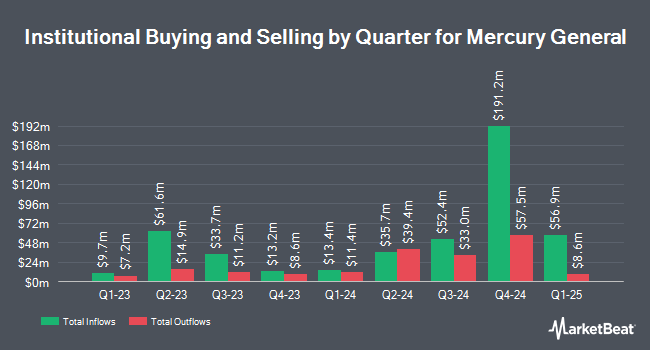

Raymond James Financial Inc. bought a new position in shares of Mercury General Co. (NYSE:MCY - Free Report) during the 4th quarter, according to its most recent 13F filing with the SEC. The firm bought 39,037 shares of the insurance provider's stock, valued at approximately $2,595,000. Raymond James Financial Inc. owned 0.07% of Mercury General as of its most recent filing with the SEC.

Other institutional investors have also recently bought and sold shares of the company. Blue Trust Inc. raised its holdings in shares of Mercury General by 68.9% during the fourth quarter. Blue Trust Inc. now owns 1,944 shares of the insurance provider's stock worth $122,000 after acquiring an additional 793 shares during the period. Harbor Capital Advisors Inc. raised its holdings in shares of Mercury General by 3.3% in the fourth quarter. Harbor Capital Advisors Inc. now owns 7,496 shares of the insurance provider's stock valued at $498,000 after purchasing an additional 238 shares during the last quarter. Geode Capital Management LLC lifted its position in Mercury General by 2.5% during the 3rd quarter. Geode Capital Management LLC now owns 623,460 shares of the insurance provider's stock worth $39,273,000 after buying an additional 15,264 shares in the last quarter. Hennessy Advisors Inc. boosted its position in Mercury General by 6.8% during the fourth quarter. Hennessy Advisors Inc. now owns 192,300 shares of the insurance provider's stock valued at $12,784,000 after purchasing an additional 12,300 shares during the last quarter. Finally, Precision Wealth Strategies LLC bought a new stake in Mercury General during the fourth quarter worth $424,000. Institutional investors own 42.39% of the company's stock.

Analysts Set New Price Targets

A number of research analysts have recently commented on the stock. StockNews.com downgraded shares of Mercury General from a "buy" rating to a "hold" rating in a research report on Thursday, February 13th. Raymond James upgraded Mercury General from an "outperform" rating to a "strong-buy" rating and lifted their price target for the stock from $70.00 to $80.00 in a report on Wednesday, February 12th.

Get Our Latest Stock Report on MCY

Mercury General Stock Performance

MCY traded up $0.21 during trading hours on Wednesday, reaching $56.36. The company's stock had a trading volume of 263,565 shares, compared to its average volume of 390,423. The company's 50-day moving average is $53.71 and its 200-day moving average is $62.28. Mercury General Co. has a 52 week low of $44.19 and a 52 week high of $80.72. The firm has a market cap of $3.12 billion, a PE ratio of 6.67 and a beta of 0.80. The company has a debt-to-equity ratio of 0.29, a quick ratio of 0.34 and a current ratio of 0.34.

Mercury General (NYSE:MCY - Get Free Report) last issued its quarterly earnings data on Tuesday, February 11th. The insurance provider reported $2.78 earnings per share for the quarter, beating the consensus estimate of $1.94 by $0.84. Mercury General had a net margin of 8.55% and a return on equity of 22.54%. On average, equities analysts forecast that Mercury General Co. will post -0.5 EPS for the current year.

Mercury General Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, March 27th. Stockholders of record on Thursday, March 13th were issued a dividend of $0.3175 per share. This represents a $1.27 dividend on an annualized basis and a dividend yield of 2.25%. The ex-dividend date was Thursday, March 13th. This is a boost from Mercury General's previous quarterly dividend of $0.32. Mercury General's payout ratio is currently 15.03%.

About Mercury General

(

Free Report)

Mercury General Corporation, together with its subsidiaries, engages in writing personal automobile insurance in the United States. The company also writes homeowners, commercial automobile, commercial property, mechanical protection, and umbrella insurance products. Its automobile insurance products include collision, property damage, bodily injury, comprehensive, personal injury protection, underinsured and uninsured motorist, and other hazards; and homeowners insurance products comprise dwelling, liability, personal property, and other coverages.

Recommended Stories

Before you consider Mercury General, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mercury General wasn't on the list.

While Mercury General currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.