Raymond James Financial Inc. purchased a new position in shares of AST SpaceMobile, Inc. (NASDAQ:ASTS - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 63,961 shares of the company's stock, valued at approximately $1,350,000.

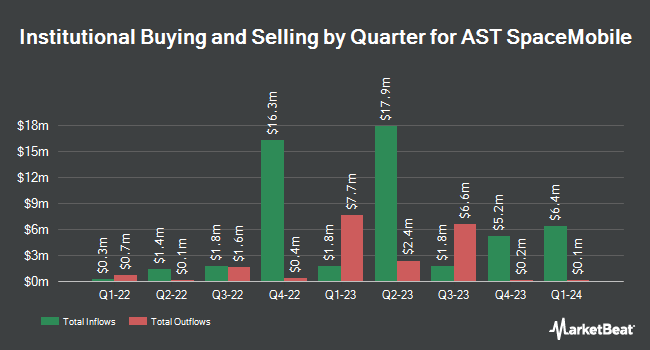

Other hedge funds and other institutional investors have also bought and sold shares of the company. Geode Capital Management LLC lifted its position in shares of AST SpaceMobile by 9.4% during the 3rd quarter. Geode Capital Management LLC now owns 3,267,066 shares of the company's stock valued at $85,450,000 after acquiring an additional 281,749 shares during the period. State Street Corp lifted its position in AST SpaceMobile by 14.8% during the third quarter. State Street Corp now owns 3,091,577 shares of the company's stock worth $80,845,000 after purchasing an additional 399,713 shares during the period. Charles Schwab Investment Management Inc. grew its stake in AST SpaceMobile by 11.9% during the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,266,713 shares of the company's stock worth $26,728,000 after buying an additional 135,008 shares in the last quarter. Oppenheimer & Co. Inc. increased its holdings in AST SpaceMobile by 0.9% in the 4th quarter. Oppenheimer & Co. Inc. now owns 854,063 shares of the company's stock valued at $18,021,000 after buying an additional 7,991 shares during the period. Finally, Bank of New York Mellon Corp raised its position in shares of AST SpaceMobile by 57.6% in the 4th quarter. Bank of New York Mellon Corp now owns 641,678 shares of the company's stock valued at $13,539,000 after buying an additional 234,517 shares in the last quarter. Institutional investors and hedge funds own 60.95% of the company's stock.

AST SpaceMobile Price Performance

Shares of NASDAQ:ASTS traded down $1.51 during trading on Friday, hitting $20.07. 13,278,353 shares of the company were exchanged, compared to its average volume of 12,154,027. AST SpaceMobile, Inc. has a 1-year low of $1.99 and a 1-year high of $39.08. The company has a market capitalization of $6.35 billion, a P/E ratio of -9.47 and a beta of 1.81. The company has a quick ratio of 5.80, a current ratio of 5.80 and a debt-to-equity ratio of 0.31. The business's 50 day moving average is $26.49 and its 200-day moving average is $24.89.

Insider Buying and Selling at AST SpaceMobile

In other AST SpaceMobile news, Director Julio A. Torres sold 20,000 shares of the company's stock in a transaction that occurred on Monday, March 10th. The shares were sold at an average price of $30.73, for a total value of $614,600.00. Following the completion of the transaction, the director now directly owns 52,628 shares in the company, valued at approximately $1,617,258.44. This represents a 27.54 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which can be accessed through this link. Corporate insiders own 41.80% of the company's stock.

Analysts Set New Price Targets

Several research firms recently issued reports on ASTS. UBS Group increased their price target on shares of AST SpaceMobile from $31.00 to $38.00 and gave the stock a "buy" rating in a research report on Wednesday, March 5th. Scotiabank reiterated an "outperform" rating on shares of AST SpaceMobile in a research note on Wednesday, March 5th. Finally, Cantor Fitzgerald reissued an "overweight" rating and set a $30.00 price target on shares of AST SpaceMobile in a report on Tuesday, March 4th. Five equities research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, AST SpaceMobile has a consensus rating of "Buy" and an average target price of $42.98.

Get Our Latest Stock Report on ASTS

AST SpaceMobile Profile

(

Free Report)

AST SpaceMobile, Inc, together with its subsidiaries, develops and provides access to a space-based cellular broadband network for smartphones in the United States. Its SpaceMobile service provides cellular broadband services to end-users who are out of terrestrial cellular coverage. The company was founded in 2017 and is headquartered in Midland, Texas.

See Also

Before you consider AST SpaceMobile, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AST SpaceMobile wasn't on the list.

While AST SpaceMobile currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.