Raymond James Financial Inc. bought a new stake in Business First Bancshares, Inc. (NASDAQ:BFST - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund bought 52,979 shares of the company's stock, valued at approximately $1,362,000. Raymond James Financial Inc. owned approximately 0.18% of Business First Bancshares as of its most recent filing with the Securities and Exchange Commission.

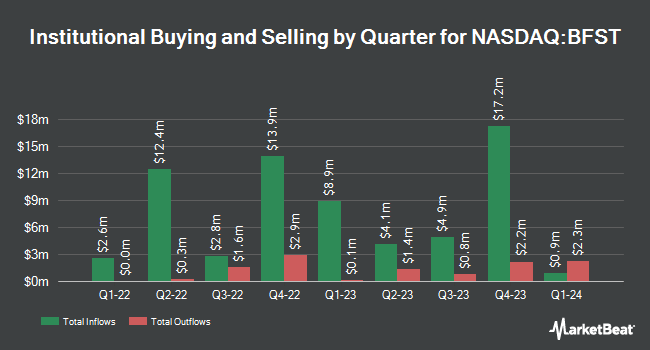

A number of other large investors have also recently bought and sold shares of BFST. Quantbot Technologies LP bought a new stake in shares of Business First Bancshares in the third quarter worth $67,000. BNP Paribas Financial Markets increased its stake in Business First Bancshares by 81.8% in the 3rd quarter. BNP Paribas Financial Markets now owns 8,631 shares of the company's stock valued at $222,000 after buying an additional 3,883 shares during the last quarter. Americana Partners LLC bought a new stake in Business First Bancshares during the 4th quarter worth about $317,000. Howard Financial Services LTD. acquired a new position in shares of Business First Bancshares during the 4th quarter worth about $466,000. Finally, Martingale Asset Management L P bought a new position in shares of Business First Bancshares in the 3rd quarter valued at about $592,000. Institutional investors and hedge funds own 47.35% of the company's stock.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on BFST shares. Hovde Group upgraded Business First Bancshares from a "market perform" rating to an "outperform" rating and upped their target price for the stock from $31.50 to $33.00 in a report on Friday, January 24th. Raymond James upgraded Business First Bancshares from a "market perform" rating to an "outperform" rating and set a $30.00 price objective on the stock in a research note on Thursday, December 19th.

Read Our Latest Analysis on Business First Bancshares

Business First Bancshares Stock Performance

Shares of BFST traded down $0.03 during midday trading on Monday, reaching $21.80. The stock had a trading volume of 179,618 shares, compared to its average volume of 83,396. The firm has a market cap of $644.23 million, a PE ratio of 9.65 and a beta of 0.75. The firm has a 50 day simple moving average of $25.72 and a 200-day simple moving average of $26.18. Business First Bancshares, Inc. has a one year low of $18.97 and a one year high of $30.30. The company has a current ratio of 0.99, a quick ratio of 0.99 and a debt-to-equity ratio of 0.75.

Business First Bancshares (NASDAQ:BFST - Get Free Report) last announced its quarterly earnings results on Thursday, January 23rd. The company reported $0.66 earnings per share for the quarter, topping analysts' consensus estimates of $0.49 by $0.17. Business First Bancshares had a return on equity of 11.88% and a net margin of 14.19%. As a group, sell-side analysts anticipate that Business First Bancshares, Inc. will post 2.72 EPS for the current year.

Business First Bancshares Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, February 28th. Shareholders of record on Saturday, February 15th were issued a dividend of $0.14 per share. This represents a $0.56 annualized dividend and a yield of 2.57%. The ex-dividend date of this dividend was Friday, February 14th. Business First Bancshares's dividend payout ratio is 24.78%.

Insiders Place Their Bets

In other news, Director Rick D. Day acquired 1,500 shares of Business First Bancshares stock in a transaction dated Wednesday, March 5th. The stock was bought at an average price of $25.46 per share, for a total transaction of $38,190.00. Following the completion of the acquisition, the director now directly owns 264,285 shares in the company, valued at approximately $6,728,696.10. The trade was a 0.57 % increase in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Company insiders own 6.45% of the company's stock.

About Business First Bancshares

(

Free Report)

Business First Bancshares, Inc operates as the bank holding company for b1BANK that provides various banking products and services in Louisiana and Texas. It offers various deposit products and services, including checking, demand, money market, time, and savings accounts; and certificates of deposits, remote deposit capture, and direct deposit services.

See Also

Before you consider Business First Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Business First Bancshares wasn't on the list.

While Business First Bancshares currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.