Raymond James Financial Inc. acquired a new stake in shares of Guardant Health, Inc. (NASDAQ:GH - Free Report) in the fourth quarter, according to the company in its most recent filing with the SEC. The firm acquired 72,364 shares of the company's stock, valued at approximately $2,211,000. Raymond James Financial Inc. owned approximately 0.06% of Guardant Health at the end of the most recent reporting period.

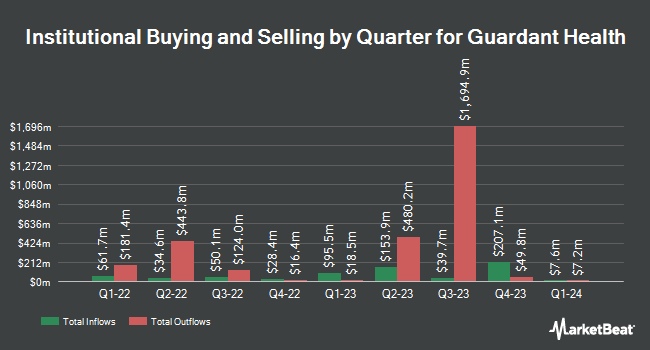

Several other large investors also recently added to or reduced their stakes in the stock. Arizona State Retirement System grew its position in shares of Guardant Health by 1.1% during the 4th quarter. Arizona State Retirement System now owns 35,639 shares of the company's stock worth $1,089,000 after buying an additional 403 shares in the last quarter. Jones Financial Companies Lllp grew its holdings in Guardant Health by 43.5% during the 4th quarter. Jones Financial Companies Lllp now owns 2,696 shares of the company's stock worth $82,000 after acquiring an additional 817 shares in the last quarter. Fiduciary Alliance LLC increased its position in Guardant Health by 7.6% during the 4th quarter. Fiduciary Alliance LLC now owns 11,879 shares of the company's stock valued at $363,000 after purchasing an additional 836 shares during the period. R Squared Ltd bought a new stake in shares of Guardant Health in the 4th quarter valued at about $26,000. Finally, Van ECK Associates Corp raised its holdings in shares of Guardant Health by 47.4% in the 4th quarter. Van ECK Associates Corp now owns 2,887 shares of the company's stock valued at $88,000 after purchasing an additional 929 shares in the last quarter. 92.60% of the stock is owned by hedge funds and other institutional investors.

Guardant Health Stock Performance

GH stock traded down $1.47 during midday trading on Thursday, reaching $42.02. The stock had a trading volume of 1,534,308 shares, compared to its average volume of 2,135,543. The firm has a fifty day simple moving average of $44.52 and a two-hundred day simple moving average of $34.71. The stock has a market cap of $5.19 billion, a PE ratio of -11.80 and a beta of 1.45. Guardant Health, Inc. has a 52-week low of $15.81 and a 52-week high of $50.89.

Guardant Health (NASDAQ:GH - Get Free Report) last released its earnings results on Thursday, February 20th. The company reported ($0.90) EPS for the quarter, missing analysts' consensus estimates of ($0.75) by ($0.15). The firm had revenue of $201.81 million for the quarter, compared to analyst estimates of $192.50 million. Guardant Health had a negative return on equity of 19,157.20% and a negative net margin of 59.05%. On average, sell-side analysts predict that Guardant Health, Inc. will post -2.9 EPS for the current fiscal year.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on GH shares. Guggenheim reiterated a "buy" rating and set a $56.00 price objective on shares of Guardant Health in a research note on Monday, February 24th. Scotiabank increased their target price on Guardant Health from $47.00 to $52.00 and gave the company a "sector outperform" rating in a research report on Monday, February 24th. Barclays assumed coverage on Guardant Health in a research report on Thursday, January 23rd. They issued an "overweight" rating and a $60.00 price target for the company. Morgan Stanley raised their price objective on Guardant Health from $42.00 to $52.00 and gave the company an "overweight" rating in a research report on Thursday, March 6th. Finally, JPMorgan Chase & Co. boosted their target price on shares of Guardant Health from $50.00 to $55.00 and gave the stock an "overweight" rating in a report on Friday, February 21st. Twenty analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and a consensus price target of $48.95.

Check Out Our Latest Research Report on Guardant Health

Guardant Health Company Profile

(

Free Report)

Guardant Health, Inc, a precision oncology company, provides blood and tissue tests, data sets, and analytics in the United States and internationally. The company provides Guardant360; Guardant360 LDT; Guardant360 CDx Test; Guardant360 Response Test; Guardant360 TissueNext Test; GuardantINFINITY Test; GuardantConnect, an integrated software-based solution designed for clinical and biopharmaceutical customers to connect patients tested with assays with actionable alterations with potentially relevant clinical studies; GuardantOMNI Test for advanced stage cancer; and GuardantINFORM, an in-silico research platform for tumor evolution and treatment resistance across various biomarker-driven cancers.

Further Reading

Before you consider Guardant Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guardant Health wasn't on the list.

While Guardant Health currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.