Raymond James Financial Inc. purchased a new position in CoStar Group, Inc. (NASDAQ:CSGP - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm purchased 642,446 shares of the technology company's stock, valued at approximately $45,993,000. Raymond James Financial Inc. owned about 0.16% of CoStar Group at the end of the most recent reporting period.

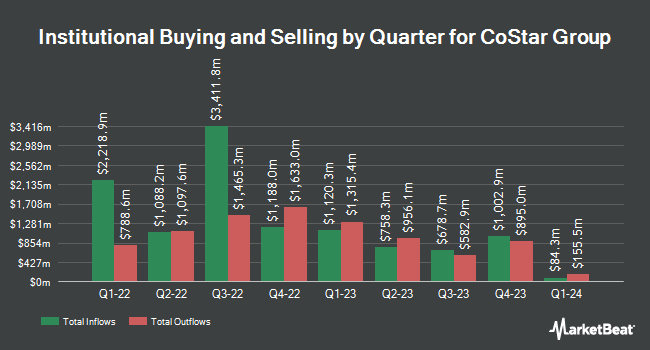

A number of other institutional investors and hedge funds have also recently modified their holdings of CSGP. Promus Capital LLC purchased a new position in CoStar Group during the fourth quarter valued at $54,000. Arizona State Retirement System lifted its position in CoStar Group by 1.7% during the fourth quarter. Arizona State Retirement System now owns 118,996 shares of the technology company's stock valued at $8,519,000 after purchasing an additional 1,960 shares in the last quarter. Verdence Capital Advisors LLC lifted its position in CoStar Group by 206.9% during the fourth quarter. Verdence Capital Advisors LLC now owns 22,488 shares of the technology company's stock valued at $1,610,000 after purchasing an additional 15,161 shares in the last quarter. Aigen Investment Management LP purchased a new position in CoStar Group during the fourth quarter valued at $323,000. Finally, Proficio Capital Partners LLC lifted its position in CoStar Group by 15.8% during the fourth quarter. Proficio Capital Partners LLC now owns 4,192 shares of the technology company's stock valued at $300,000 after purchasing an additional 573 shares in the last quarter. 96.60% of the stock is currently owned by hedge funds and other institutional investors.

CoStar Group Trading Down 3.8 %

Shares of NASDAQ CSGP opened at $76.87 on Wednesday. The business's 50 day moving average is $74.99 and its two-hundred day moving average is $75.66. The company has a debt-to-equity ratio of 0.13, a current ratio of 8.96 and a quick ratio of 9.63. CoStar Group, Inc. has a 1-year low of $68.26 and a 1-year high of $100.38. The stock has a market capitalization of $31.53 billion, a P/E ratio of 219.63 and a beta of 0.93.

CoStar Group (NASDAQ:CSGP - Get Free Report) last issued its quarterly earnings data on Tuesday, February 18th. The technology company reported $0.22 earnings per share for the quarter, hitting the consensus estimate of $0.22. CoStar Group had a return on equity of 3.11% and a net margin of 5.07%. The company had revenue of $709.40 million for the quarter, compared to analysts' expectations of $703.00 million. As a group, research analysts expect that CoStar Group, Inc. will post 0.94 EPS for the current year.

CoStar Group announced that its Board of Directors has authorized a stock buyback program on Tuesday, February 18th that authorizes the company to buyback $500.00 million in outstanding shares. This buyback authorization authorizes the technology company to purchase up to 1.6% of its shares through open market purchases. Shares buyback programs are typically a sign that the company's board of directors believes its stock is undervalued.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on CSGP shares. The Goldman Sachs Group started coverage on CoStar Group in a research report on Friday, February 28th. They set a "buy" rating on the stock. JMP Securities reissued a "market outperform" rating and set a $90.00 price target on shares of CoStar Group in a report on Monday, December 16th. Deutsche Bank Aktiengesellschaft started coverage on CoStar Group in a report on Friday, February 28th. They set a "buy" rating and a $89.00 price target on the stock. Piper Sandler started coverage on CoStar Group in a report on Friday, February 28th. They set an "overweight" rating on the stock. Finally, Craig Hallum started coverage on CoStar Group in a report on Friday, February 28th. They set a "buy" rating on the stock. Two research analysts have rated the stock with a sell rating, four have given a hold rating and twelve have assigned a buy rating to the stock. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $88.07.

View Our Latest Analysis on CoStar Group

About CoStar Group

(

Free Report)

CoStar Group, Inc provides information, analytics, and online marketplace services to the commercial real estate, hospitality, residential, and related professionals industries in the United States, Canada, Europe, the Asia Pacific, and Latin America. The company offers CoStar Property that provides inventory of office, industrial, retail, multifamily, hospitality, and student housing properties and land; CoStar Sales, a robust database of comparable commercial real estate sales transactions; CoStar Market Analytics to view and report on aggregated market and submarket trends; and CoStar Tenant, an online business-to-business prospecting and analytical tool that provides tenant information.

Featured Stories

Want to see what other hedge funds are holding CSGP? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for CoStar Group, Inc. (NASDAQ:CSGP - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CoStar Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CoStar Group wasn't on the list.

While CoStar Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.