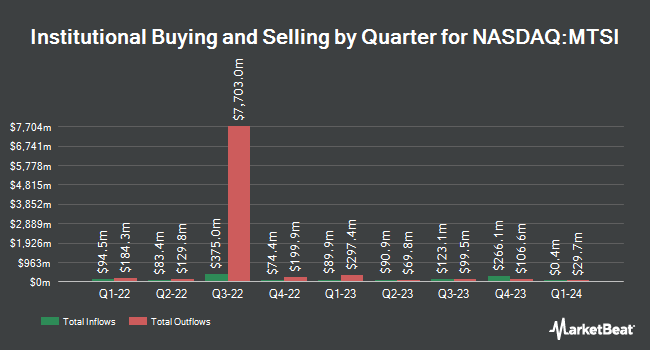

Raymond James Financial Inc. bought a new position in MACOM Technology Solutions Holdings, Inc. (NASDAQ:MTSI - Free Report) in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The fund bought 66,426 shares of the semiconductor company's stock, valued at approximately $8,630,000. Raymond James Financial Inc. owned approximately 0.09% of MACOM Technology Solutions as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors have also added to or reduced their stakes in MTSI. UMB Bank n.a. boosted its holdings in shares of MACOM Technology Solutions by 74.3% in the 4th quarter. UMB Bank n.a. now owns 237 shares of the semiconductor company's stock worth $31,000 after purchasing an additional 101 shares in the last quarter. Empowered Funds LLC purchased a new stake in MACOM Technology Solutions in the fourth quarter worth approximately $33,000. SBI Securities Co. Ltd. purchased a new stake in MACOM Technology Solutions in the fourth quarter worth approximately $35,000. ORG Wealth Partners LLC bought a new position in MACOM Technology Solutions during the fourth quarter valued at approximately $36,000. Finally, Smartleaf Asset Management LLC raised its stake in shares of MACOM Technology Solutions by 97.2% during the fourth quarter. Smartleaf Asset Management LLC now owns 280 shares of the semiconductor company's stock worth $36,000 after acquiring an additional 138 shares in the last quarter. Institutional investors own 76.14% of the company's stock.

Insiders Place Their Bets

In related news, Director Geoffrey G. Ribar sold 6,656 shares of the company's stock in a transaction dated Wednesday, February 12th. The shares were sold at an average price of $121.61, for a total value of $809,436.16. Following the transaction, the director now owns 14,031 shares in the company, valued at $1,706,309.91. The trade was a 32.17 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CFO John Kober sold 2,250 shares of the firm's stock in a transaction dated Thursday, January 2nd. The shares were sold at an average price of $130.09, for a total transaction of $292,702.50. Following the sale, the chief financial officer now owns 49,239 shares of the company's stock, valued at approximately $6,405,501.51. This represents a 4.37 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 746,198 shares of company stock worth $92,503,343 over the last three months. Company insiders own 16.30% of the company's stock.

MACOM Technology Solutions Trading Down 5.9 %

NASDAQ:MTSI traded down $6.59 during mid-day trading on Wednesday, reaching $105.65. 819,070 shares of the company's stock traded hands, compared to its average volume of 621,138. The company has a 50 day moving average price of $121.77 and a 200-day moving average price of $122.63. The firm has a market capitalization of $7.85 billion, a price-to-earnings ratio of -73.37, a PEG ratio of 2.42 and a beta of 1.74. The company has a debt-to-equity ratio of 0.33, a current ratio of 3.61 and a quick ratio of 2.88. MACOM Technology Solutions Holdings, Inc. has a 12-month low of $90.01 and a 12-month high of $152.50.

MACOM Technology Solutions (NASDAQ:MTSI - Get Free Report) last posted its earnings results on Thursday, February 6th. The semiconductor company reported $0.40 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.78 by ($0.38). MACOM Technology Solutions had a negative net margin of 13.05% and a positive return on equity of 12.42%. On average, sell-side analysts predict that MACOM Technology Solutions Holdings, Inc. will post 2.43 earnings per share for the current year.

Analyst Ratings Changes

A number of equities research analysts have recently issued reports on the stock. Northland Securities raised shares of MACOM Technology Solutions from a "market perform" rating to an "outperform" rating and upped their price objective for the company from $105.00 to $140.00 in a research note on Monday, February 10th. Benchmark restated a "buy" rating and set a $160.00 price target on shares of MACOM Technology Solutions in a research report on Monday, February 10th. Finally, Northland Capmk upgraded MACOM Technology Solutions from a "hold" rating to a "strong-buy" rating in a report on Monday, February 10th. Two equities research analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, MACOM Technology Solutions has a consensus rating of "Moderate Buy" and an average target price of $131.50.

Get Our Latest Stock Analysis on MACOM Technology Solutions

About MACOM Technology Solutions

(

Free Report)

MACOM Technology Solutions Holdings, Inc, together with its subsidiaries, designs and manufactures analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum in the United States, China, Australia, Japan, Malaysia, Singapore, South Korea, Taiwan, Thailand, and internationally.

Recommended Stories

Before you consider MACOM Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MACOM Technology Solutions wasn't on the list.

While MACOM Technology Solutions currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.