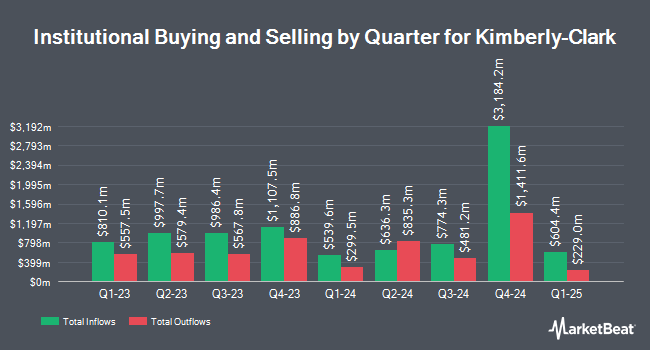

Raymond James Financial Inc. acquired a new stake in shares of Kimberly-Clark Co. (NYSE:KMB - Free Report) in the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 972,495 shares of the company's stock, valued at approximately $127,436,000. Raymond James Financial Inc. owned 0.29% of Kimberly-Clark as of its most recent SEC filing.

Several other institutional investors also recently made changes to their positions in KMB. State Street Corp grew its stake in shares of Kimberly-Clark by 5.9% during the 3rd quarter. State Street Corp now owns 19,304,396 shares of the company's stock valued at $2,768,367,000 after buying an additional 1,083,824 shares during the period. Sarasin & Partners LLP boosted its position in Kimberly-Clark by 140.1% during the 4th quarter. Sarasin & Partners LLP now owns 988,294 shares of the company's stock worth $129,506,000 after purchasing an additional 576,610 shares during the period. Assenagon Asset Management S.A. lifted its holdings in Kimberly-Clark by 1,427.4% in the 4th quarter. Assenagon Asset Management S.A. now owns 589,771 shares of the company's stock worth $77,284,000 after buying an additional 551,158 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its holdings in Kimberly-Clark by 5.3% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 10,589,967 shares of the company's stock worth $1,387,709,000 after buying an additional 529,223 shares in the last quarter. Finally, Nordea Investment Management AB lifted its holdings in Kimberly-Clark by 20.4% in the 4th quarter. Nordea Investment Management AB now owns 2,740,525 shares of the company's stock worth $358,625,000 after buying an additional 464,615 shares in the last quarter. 76.29% of the stock is owned by hedge funds and other institutional investors.

Kimberly-Clark Stock Performance

KMB traded down $3.38 on Tuesday, hitting $144.02. 2,507,282 shares of the company's stock were exchanged, compared to its average volume of 2,045,741. The firm has a market cap of $47.77 billion, a PE ratio of 19.08, a P/E/G ratio of 4.46 and a beta of 0.36. Kimberly-Clark Co. has a twelve month low of $123.02 and a twelve month high of $150.45. The stock has a fifty day moving average of $132.96 and a two-hundred day moving average of $136.48. The company has a current ratio of 0.80, a quick ratio of 0.54 and a debt-to-equity ratio of 7.05.

Kimberly-Clark (NYSE:KMB - Get Free Report) last posted its earnings results on Tuesday, January 28th. The company reported $1.50 EPS for the quarter, hitting the consensus estimate of $1.50. Kimberly-Clark had a net margin of 12.69% and a return on equity of 201.43%. On average, research analysts anticipate that Kimberly-Clark Co. will post 7.5 earnings per share for the current fiscal year.

Kimberly-Clark Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, April 2nd. Shareholders of record on Friday, March 7th will be given a $1.26 dividend. This is a boost from Kimberly-Clark's previous quarterly dividend of $1.22. The ex-dividend date is Friday, March 7th. This represents a $5.04 annualized dividend and a yield of 3.50%. Kimberly-Clark's dividend payout ratio is 66.75%.

Analyst Ratings Changes

KMB has been the topic of a number of recent analyst reports. JPMorgan Chase & Co. cut their price objective on shares of Kimberly-Clark from $140.00 to $124.00 and set an "underweight" rating on the stock in a report on Thursday, January 16th. Citigroup cut their price objective on shares of Kimberly-Clark from $125.00 to $118.00 and set a "sell" rating on the stock in a report on Wednesday, January 15th. Barclays cut their target price on shares of Kimberly-Clark from $144.00 to $132.00 and set an "equal weight" rating on the stock in a research note on Friday, January 17th. StockNews.com upgraded shares of Kimberly-Clark from a "hold" rating to a "buy" rating in a research note on Thursday, March 6th. Finally, Wells Fargo & Company cut their target price on shares of Kimberly-Clark from $140.00 to $130.00 and set an "equal weight" rating on the stock in a research note on Tuesday, January 7th. Two research analysts have rated the stock with a sell rating, eight have assigned a hold rating and six have issued a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Hold" and an average price target of $143.64.

View Our Latest Report on Kimberly-Clark

Insiders Place Their Bets

In other Kimberly-Clark news, VP Andrew Drexler sold 10,838 shares of the company's stock in a transaction dated Friday, February 28th. The shares were sold at an average price of $141.00, for a total value of $1,528,158.00. Following the completion of the transaction, the vice president now owns 7,720 shares in the company, valued at approximately $1,088,520. This represents a 58.40 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 0.62% of the stock is owned by insiders.

Kimberly-Clark Profile

(

Free Report)

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products in the United States. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The company's Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, reusable underwear, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Thinx, Poise, Depend, Plenitud, Softex, and other brand names.

Featured Stories

Before you consider Kimberly-Clark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimberly-Clark wasn't on the list.

While Kimberly-Clark currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report