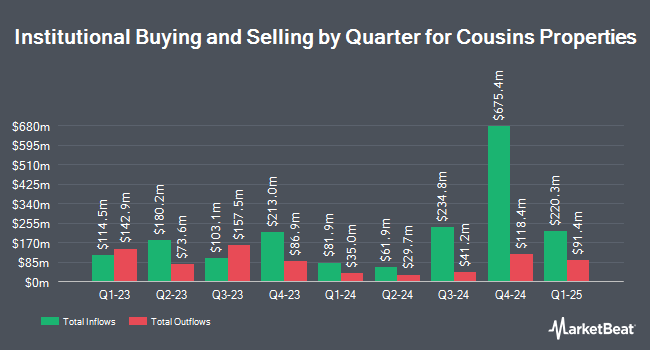

Raymond James Financial Inc. acquired a new stake in Cousins Properties Incorporated (NYSE:CUZ - Free Report) in the fourth quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor acquired 820,726 shares of the real estate investment trust's stock, valued at approximately $25,148,000. Raymond James Financial Inc. owned approximately 0.52% of Cousins Properties as of its most recent SEC filing.

Several other hedge funds and other institutional investors have also recently modified their holdings of the company. Jones Financial Companies Lllp boosted its position in Cousins Properties by 1,609.3% during the 4th quarter. Jones Financial Companies Lllp now owns 923 shares of the real estate investment trust's stock worth $28,000 after acquiring an additional 869 shares during the last quarter. UMB Bank n.a. boosted its holdings in Cousins Properties by 67.4% during the fourth quarter. UMB Bank n.a. now owns 981 shares of the real estate investment trust's stock worth $30,000 after purchasing an additional 395 shares during the last quarter. Larson Financial Group LLC grew its position in Cousins Properties by 49.7% in the third quarter. Larson Financial Group LLC now owns 1,319 shares of the real estate investment trust's stock valued at $39,000 after purchasing an additional 438 shares in the last quarter. Quarry LP increased its stake in Cousins Properties by 74.5% in the 3rd quarter. Quarry LP now owns 3,976 shares of the real estate investment trust's stock valued at $117,000 after buying an additional 1,697 shares during the last quarter. Finally, BankPlus Trust Department bought a new stake in Cousins Properties during the 4th quarter worth about $142,000. Institutional investors and hedge funds own 94.38% of the company's stock.

Wall Street Analyst Weigh In

Several brokerages have recently weighed in on CUZ. Jefferies Financial Group initiated coverage on Cousins Properties in a report on Monday. They issued a "buy" rating and a $35.00 price objective for the company. Truist Financial raised their price target on Cousins Properties from $30.00 to $33.00 and gave the company a "buy" rating in a research note on Wednesday, December 18th. StockNews.com upgraded Cousins Properties from a "sell" rating to a "hold" rating in a research note on Tuesday. Mizuho raised shares of Cousins Properties from an "underperform" rating to a "neutral" rating and raised their target price for the company from $22.00 to $30.00 in a research note on Tuesday, January 7th. Finally, Robert W. Baird dropped their price target on shares of Cousins Properties from $34.00 to $33.00 and set an "outperform" rating on the stock in a research report on Monday, February 24th. Four research analysts have rated the stock with a hold rating and six have given a buy rating to the company. According to MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $32.89.

Check Out Our Latest Analysis on CUZ

Cousins Properties Stock Performance

Shares of CUZ traded up $0.29 during trading hours on Wednesday, hitting $29.81. The company had a trading volume of 474,535 shares, compared to its average volume of 1,367,390. The firm has a market cap of $5.00 billion, a price-to-earnings ratio of 99.38, a PEG ratio of 2.98 and a beta of 1.28. The company has a quick ratio of 0.74, a current ratio of 0.74 and a debt-to-equity ratio of 0.64. The business has a fifty day moving average of $29.92 and a 200-day moving average of $30.17. Cousins Properties Incorporated has a 12 month low of $21.58 and a 12 month high of $32.55.

Cousins Properties (NYSE:CUZ - Get Free Report) last issued its quarterly earnings data on Thursday, February 6th. The real estate investment trust reported $0.69 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.07 by $0.62. Cousins Properties had a return on equity of 1.00% and a net margin of 5.36%. Equities analysts anticipate that Cousins Properties Incorporated will post 2.76 EPS for the current fiscal year.

Cousins Properties Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Thursday, April 3rd will be paid a dividend of $0.32 per share. This represents a $1.28 annualized dividend and a dividend yield of 4.29%. Cousins Properties's payout ratio is currently 426.67%.

About Cousins Properties

(

Free Report)

Cousins Properties Incorporated ("Cousins") is a fully integrated, self-administered, and self-managed real estate investment trust (REIT). The Company, based in Atlanta and acting through its operating partnership, Cousins Properties LP, primarily invests in Class A office buildings located in high-growth Sun Belt markets.

Recommended Stories

Before you consider Cousins Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cousins Properties wasn't on the list.

While Cousins Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.