Raymond James Financial Inc. bought a new stake in shares of Arhaus, Inc. (NASDAQ:ARHS - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor bought 56,411 shares of the company's stock, valued at approximately $530,000.

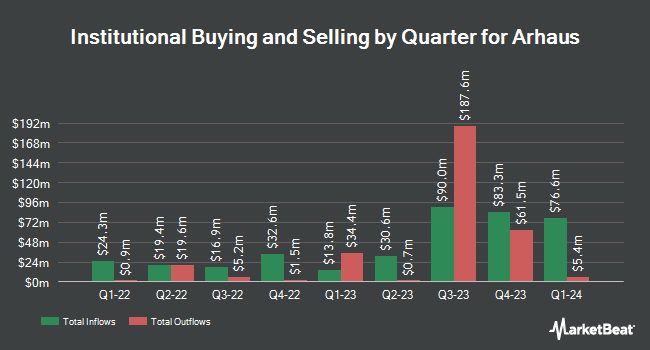

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in ARHS. Victory Capital Management Inc. boosted its position in shares of Arhaus by 27.8% in the fourth quarter. Victory Capital Management Inc. now owns 33,103 shares of the company's stock valued at $311,000 after acquiring an additional 7,210 shares during the period. Charles Schwab Investment Management Inc. boosted its holdings in Arhaus by 3.0% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 439,299 shares of the company's stock valued at $4,129,000 after purchasing an additional 12,724 shares during the period. Bank of New York Mellon Corp grew its position in Arhaus by 8.2% in the 4th quarter. Bank of New York Mellon Corp now owns 1,584,443 shares of the company's stock worth $14,894,000 after purchasing an additional 120,582 shares during the last quarter. Wrapmanager Inc. bought a new position in shares of Arhaus during the 4th quarter worth about $177,000. Finally, Acuitas Investments LLC raised its position in shares of Arhaus by 56.0% during the fourth quarter. Acuitas Investments LLC now owns 355,871 shares of the company's stock valued at $3,345,000 after buying an additional 127,700 shares during the last quarter. Institutional investors and hedge funds own 27.88% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts recently issued reports on ARHS shares. Loop Capital began coverage on Arhaus in a research note on Friday, January 24th. They set a "hold" rating and a $12.00 price target on the stock. Stifel Nicolaus cut their target price on Arhaus from $14.00 to $11.50 and set a "buy" rating for the company in a research note on Monday, March 3rd. Jefferies Financial Group lifted their price target on shares of Arhaus from $9.50 to $10.00 and gave the stock a "hold" rating in a research note on Friday, January 10th. Robert W. Baird cut shares of Arhaus from an "outperform" rating to a "neutral" rating and dropped their price objective for the company from $13.00 to $8.50 in a research note on Monday, April 7th. Finally, Telsey Advisory Group reissued an "outperform" rating and issued a $11.00 target price on shares of Arhaus in a research note on Wednesday, February 26th. Eight analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. According to MarketBeat, Arhaus currently has a consensus rating of "Hold" and a consensus target price of $11.18.

Read Our Latest Analysis on Arhaus

Arhaus Price Performance

Arhaus stock traded down $0.09 during trading hours on Friday, hitting $7.90. 2,598,935 shares of the stock were exchanged, compared to its average volume of 1,569,136. The stock has a market capitalization of $1.11 billion, a P/E ratio of 14.11, a P/E/G ratio of 11.57 and a beta of 2.64. The business's 50-day moving average is $9.88 and its two-hundred day moving average is $10.12. The company has a debt-to-equity ratio of 0.17, a quick ratio of 0.52 and a current ratio of 1.23. Arhaus, Inc. has a 12 month low of $6.61 and a 12 month high of $19.81.

About Arhaus

(

Free Report)

Arhaus, Inc operates as a lifestyle brand and premium retailer in the home furnishings market in the United States. It provides merchandise assortments across various categories, including furniture, lighting, textiles, décor, and outdoor. The company's furniture products comprise bedroom, dining room, living room, and home office furnishings, which includes sofas, dining tables and chairs, accent chairs, console and coffee tables, beds, headboards, dressers, desks, bookcases, modular storage, and other items; and outdoor products, such as outdoor dining tables, chairs, chaises and other furniture, lighting, textiles, décor, umbrellas, and fire pits.

Further Reading

Before you consider Arhaus, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arhaus wasn't on the list.

While Arhaus currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.