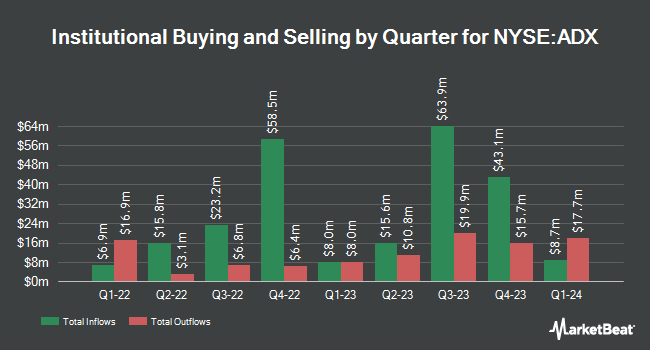

Raymond James Financial Inc. purchased a new stake in Adams Diversified Equity Fund, Inc. (NYSE:ADX - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund purchased 1,031,487 shares of the closed-end fund's stock, valued at approximately $20,836,000. Raymond James Financial Inc. owned approximately 0.83% of Adams Diversified Equity Fund as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Steward Partners Investment Advisory LLC boosted its position in Adams Diversified Equity Fund by 9.4% in the fourth quarter. Steward Partners Investment Advisory LLC now owns 6,687 shares of the closed-end fund's stock valued at $135,000 after buying an additional 576 shares in the last quarter. Atria Wealth Solutions Inc. boosted its position in Adams Diversified Equity Fund by 1.7% in the fourth quarter. Atria Wealth Solutions Inc. now owns 35,519 shares of the closed-end fund's stock valued at $717,000 after buying an additional 608 shares in the last quarter. Kingsview Wealth Management LLC boosted its position in Adams Diversified Equity Fund by 6.5% in the fourth quarter. Kingsview Wealth Management LLC now owns 11,778 shares of the closed-end fund's stock valued at $238,000 after buying an additional 717 shares in the last quarter. Founders Capital Management LLC boosted its position in Adams Diversified Equity Fund by 8.8% in the fourth quarter. Founders Capital Management LLC now owns 11,116 shares of the closed-end fund's stock valued at $225,000 after buying an additional 903 shares in the last quarter. Finally, Financial Counselors Inc. boosted its position in Adams Diversified Equity Fund by 2.1% in the third quarter. Financial Counselors Inc. now owns 46,965 shares of the closed-end fund's stock valued at $1,013,000 after buying an additional 950 shares in the last quarter. 28.41% of the stock is currently owned by institutional investors and hedge funds.

Adams Diversified Equity Fund Price Performance

NYSE:ADX traded down $0.02 on Thursday, reaching $19.07. The stock had a trading volume of 151,564 shares, compared to its average volume of 238,341. Adams Diversified Equity Fund, Inc. has a 1-year low of $18.36 and a 1-year high of $22.63. The stock has a fifty day moving average price of $20.24 and a 200-day moving average price of $20.87.

Adams Diversified Equity Fund Cuts Dividend

The business also recently announced a quarterly dividend, which was paid on Friday, February 28th. Stockholders of record on Monday, January 27th were given a dividend of $0.47 per share. The ex-dividend date of this dividend was Monday, January 27th. This represents a $1.88 dividend on an annualized basis and a dividend yield of 9.86%.

Adams Diversified Equity Fund Profile

(

Free Report)

Adams Diversified Equity Fund, Inc is a publicly owned investment manager. It primarily provides its services to investment companies. The firm is a large advisory firm The firm is actively engaged in businesses, including commodity pool operator or commodity trading advisor. The firm launches equity.

Further Reading

Before you consider Adams Diversified Equity Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adams Diversified Equity Fund wasn't on the list.

While Adams Diversified Equity Fund currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.