Raymond James Financial Inc. purchased a new position in shares of Opera Limited (NASDAQ:OPRA - Free Report) during the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 86,259 shares of the company's stock, valued at approximately $1,634,000. Raymond James Financial Inc. owned about 0.10% of Opera as of its most recent filing with the Securities and Exchange Commission (SEC).

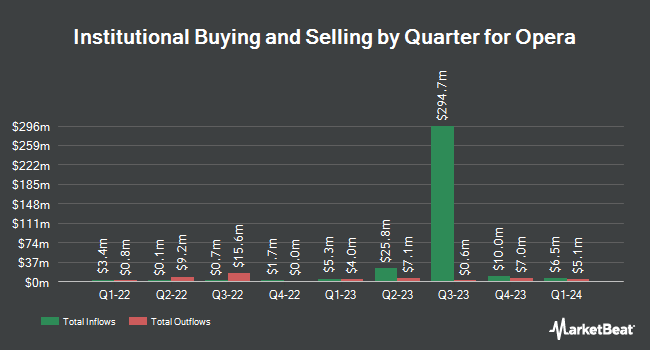

A number of other hedge funds have also bought and sold shares of OPRA. Quantbot Technologies LP bought a new position in Opera during the 3rd quarter worth approximately $74,000. Rockefeller Capital Management L.P. lifted its stake in Opera by 44.0% during the third quarter. Rockefeller Capital Management L.P. now owns 275,034 shares of the company's stock worth $4,249,000 after purchasing an additional 84,001 shares during the last quarter. Centiva Capital LP acquired a new position in Opera in the third quarter worth $300,000. Penn Mutual Asset Management bought a new stake in Opera during the third quarter valued at $952,000. Finally, Portolan Capital Management LLC raised its holdings in shares of Opera by 63.5% during the third quarter. Portolan Capital Management LLC now owns 711,820 shares of the company's stock worth $10,998,000 after purchasing an additional 276,356 shares during the period. 10.21% of the stock is currently owned by institutional investors and hedge funds.

Opera Stock Performance

NASDAQ OPRA traded down $1.14 during trading hours on Friday, hitting $13.95. The company had a trading volume of 903,541 shares, compared to its average volume of 587,785. Opera Limited has a fifty-two week low of $10.11 and a fifty-two week high of $22.50. The firm has a market cap of $1.23 billion, a P/E ratio of 7.08 and a beta of 0.96. The company has a quick ratio of 2.10, a current ratio of 2.10 and a debt-to-equity ratio of 0.01. The business has a fifty day simple moving average of $18.41 and a 200-day simple moving average of $17.95.

Analysts Set New Price Targets

Separately, Piper Sandler assumed coverage on shares of Opera in a report on Wednesday, February 5th. They issued an "overweight" rating and a $25.00 price target for the company. Five equities research analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock has an average rating of "Buy" and a consensus price target of $24.80.

View Our Latest Analysis on Opera

About Opera

(

Free Report)

Opera Limited, together with its subsidiaries, provides mobile and PC web browsers and related products and services in Norway and internationally. The company offers mobile browser products, such as Opera Mini, Opera browser for Android and iOS, and Opera GX for PCs and Mobile; Opera Touch; PC browsers, including Opera for Computers and Opera GX; Apex Football; Opera VPN Pro; and Opera News, an AI-powered personalized news discovery and aggregation service.

See Also

Before you consider Opera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Opera wasn't on the list.

While Opera currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.