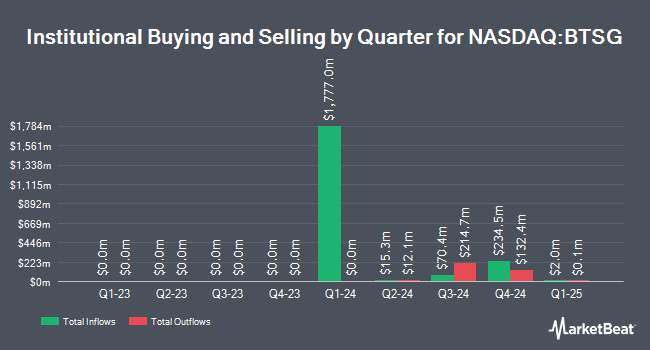

Raymond James Financial Inc. acquired a new stake in BrightSpring Health Services, Inc. (NASDAQ:BTSG - Free Report) during the 4th quarter, according to the company in its most recent filing with the SEC. The institutional investor acquired 1,072,040 shares of the company's stock, valued at approximately $18,257,000. Raymond James Financial Inc. owned 0.62% of BrightSpring Health Services as of its most recent filing with the SEC.

Other large investors have also recently added to or reduced their stakes in the company. Charles Schwab Investment Management Inc. grew its stake in shares of BrightSpring Health Services by 2.4% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 450,993 shares of the company's stock valued at $7,680,000 after buying an additional 10,658 shares in the last quarter. Bank of New York Mellon Corp lifted its stake in BrightSpring Health Services by 28.5% in the fourth quarter. Bank of New York Mellon Corp now owns 157,213 shares of the company's stock valued at $2,677,000 after acquiring an additional 34,907 shares during the last quarter. Rhumbline Advisers grew its position in BrightSpring Health Services by 1.5% in the fourth quarter. Rhumbline Advisers now owns 73,583 shares of the company's stock worth $1,253,000 after acquiring an additional 1,118 shares in the last quarter. Legato Capital Management LLC increased its stake in shares of BrightSpring Health Services by 40.0% during the 4th quarter. Legato Capital Management LLC now owns 66,910 shares of the company's stock worth $1,139,000 after purchasing an additional 19,120 shares during the last quarter. Finally, R Squared Ltd acquired a new position in shares of BrightSpring Health Services during the 4th quarter worth $74,000.

Wall Street Analysts Forecast Growth

BTSG has been the subject of a number of recent research reports. Bank of America upped their price objective on shares of BrightSpring Health Services from $19.00 to $21.00 and gave the stock a "buy" rating in a report on Wednesday, December 11th. CJS Securities began coverage on BrightSpring Health Services in a research note on Thursday, December 12th. They issued an "outperform" rating and a $27.00 price objective on the stock. Wells Fargo & Company upped their target price on BrightSpring Health Services from $17.00 to $21.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 27th. UBS Group lifted their price target on shares of BrightSpring Health Services from $22.00 to $30.00 and gave the company a "buy" rating in a research report on Wednesday, January 29th. Finally, Morgan Stanley upped their price objective on shares of BrightSpring Health Services from $19.00 to $20.00 and gave the stock an "overweight" rating in a report on Tuesday, December 17th. One investment analyst has rated the stock with a hold rating and nine have issued a buy rating to the company. According to MarketBeat.com, BrightSpring Health Services currently has an average rating of "Moderate Buy" and an average price target of $21.67.

Read Our Latest Report on BrightSpring Health Services

BrightSpring Health Services Price Performance

NASDAQ:BTSG traded up $0.49 during mid-day trading on Wednesday, hitting $18.21. The company's stock had a trading volume of 274,151 shares, compared to its average volume of 1,265,870. The company has a market capitalization of $3.19 billion, a price-to-earnings ratio of -70.01 and a beta of 2.20. The company has a current ratio of 1.35, a quick ratio of 0.97 and a debt-to-equity ratio of 1.63. BrightSpring Health Services, Inc. has a fifty-two week low of $8.84 and a fifty-two week high of $24.82. The stock has a fifty day moving average of $20.04 and a 200-day moving average of $17.79.

About BrightSpring Health Services

(

Free Report)

BrightSpring Health Services, Inc operates a home and community-based healthcare services platform in the United States. The company's platform focuses on delivering pharmacy and provider services, including clinical and supportive care in home and community settings to Medicare, Medicaid, and insured populations.

See Also

Before you consider BrightSpring Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BrightSpring Health Services wasn't on the list.

While BrightSpring Health Services currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.