Raymond James Financial Inc. purchased a new stake in TC Energy Co. (NYSE:TRP - Free Report) TSE: TRP in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 1,621,838 shares of the pipeline company's stock, valued at approximately $75,464,000. Raymond James Financial Inc. owned 0.16% of TC Energy as of its most recent filing with the Securities and Exchange Commission (SEC).

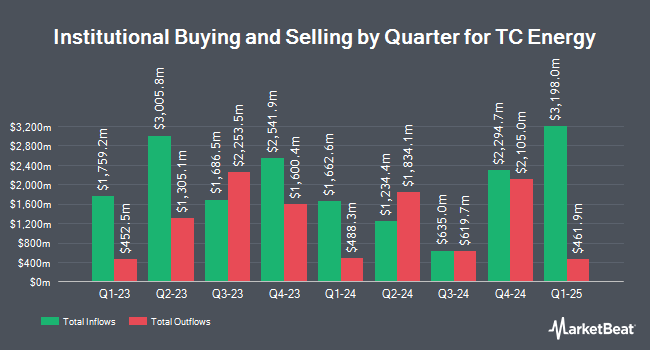

A number of other large investors have also recently modified their holdings of the company. SBI Securities Co. Ltd. purchased a new stake in TC Energy during the fourth quarter worth $31,000. Versant Capital Management Inc purchased a new stake in TC Energy during the fourth quarter worth $33,000. Synergy Investment Management LLC purchased a new stake in TC Energy during the fourth quarter worth $36,000. Point72 DIFC Ltd purchased a new stake in TC Energy during the third quarter worth $39,000. Finally, First Command Advisory Services Inc. purchased a new stake in TC Energy during the fourth quarter worth $46,000. Hedge funds and other institutional investors own 83.13% of the company's stock.

Wall Street Analyst Weigh In

TRP has been the subject of a number of analyst reports. Royal Bank of Canada upped their target price on TC Energy from $71.00 to $74.00 and gave the stock an "outperform" rating in a report on Tuesday, February 18th. BMO Capital Markets increased their price objective on TC Energy from $66.00 to $70.00 and gave the company a "market perform" rating in a report on Wednesday, November 20th. Veritas upgraded TC Energy from a "strong sell" rating to a "strong-buy" rating in a report on Tuesday, February 18th. US Capital Advisors upgraded TC Energy from a "hold" rating to a "moderate buy" rating in a report on Monday, February 3rd. Finally, TD Securities began coverage on TC Energy in a report on Wednesday, January 15th. They set a "buy" rating for the company. One analyst has rated the stock with a sell rating, two have given a hold rating, six have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $62.00.

Check Out Our Latest Stock Analysis on TRP

TC Energy Stock Performance

Shares of NYSE TRP traded up $0.30 during mid-day trading on Monday, hitting $46.18. The stock had a trading volume of 2,047,991 shares, compared to its average volume of 2,582,767. The company has a debt-to-equity ratio of 1.56, a quick ratio of 1.23 and a current ratio of 0.55. The company has a 50 day moving average of $46.28 and a two-hundred day moving average of $46.75. TC Energy Co. has a twelve month low of $34.95 and a twelve month high of $50.37. The firm has a market cap of $47.99 billion, a PE ratio of 14.25, a PEG ratio of 4.34 and a beta of 0.83.

TC Energy (NYSE:TRP - Get Free Report) TSE: TRP last announced its quarterly earnings results on Friday, February 14th. The pipeline company reported $1.05 earnings per share for the quarter, topping the consensus estimate of $0.51 by $0.54. The company had revenue of $2.56 billion for the quarter, compared to the consensus estimate of $2.42 billion. TC Energy had a return on equity of 12.12% and a net margin of 29.40%. During the same period last year, the firm earned $1.35 EPS. Research analysts predict that TC Energy Co. will post 2.63 EPS for the current fiscal year.

TC Energy Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, April 30th. Shareholders of record on Monday, March 31st will be given a dividend of $0.85 per share. This is an increase from TC Energy's previous quarterly dividend of $0.82. This represents a $3.40 annualized dividend and a yield of 7.36%. The ex-dividend date of this dividend is Monday, March 31st. TC Energy's dividend payout ratio (DPR) is currently 72.53%.

TC Energy Profile

(

Free Report)

TC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Energy Solutions. The company builds and operates a network of 93,600 kilometers of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses.

Featured Stories

Before you consider TC Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TC Energy wasn't on the list.

While TC Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Get this report to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.