Raymond James Financial Inc. bought a new position in shares of Skeena Resources Limited (NYSE:SKE - Free Report) in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund bought 153,898 shares of the company's stock, valued at approximately $1,342,000. Raymond James Financial Inc. owned approximately 0.14% of Skeena Resources as of its most recent SEC filing.

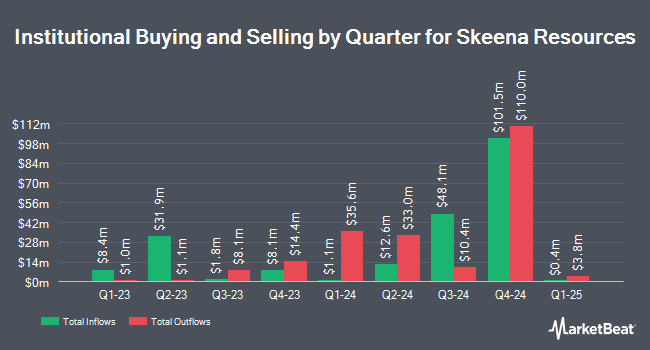

Several other hedge funds have also recently modified their holdings of SKE. Helikon Investments Ltd raised its position in shares of Skeena Resources by 316.1% in the fourth quarter. Helikon Investments Ltd now owns 8,930,424 shares of the company's stock valued at $77,873,000 after buying an additional 6,784,027 shares during the last quarter. Jane Street Group LLC raised its holdings in Skeena Resources by 90.1% in the 3rd quarter. Jane Street Group LLC now owns 138,453 shares of the company's stock valued at $1,176,000 after acquiring an additional 65,627 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC purchased a new position in Skeena Resources in the 3rd quarter worth approximately $547,000. Sprott Inc. boosted its holdings in shares of Skeena Resources by 5.1% during the 4th quarter. Sprott Inc. now owns 1,109,950 shares of the company's stock worth $9,674,000 after purchasing an additional 54,242 shares during the last quarter. Finally, National Bank of Canada FI grew its position in shares of Skeena Resources by 356.4% in the third quarter. National Bank of Canada FI now owns 51,922 shares of the company's stock valued at $439,000 after purchasing an additional 40,546 shares in the last quarter. Institutional investors and hedge funds own 45.15% of the company's stock.

Skeena Resources Stock Performance

Shares of NYSE SKE traded up $0.04 during trading on Monday, hitting $8.98. 604,105 shares of the company were exchanged, compared to its average volume of 360,869. Skeena Resources Limited has a 12-month low of $4.10 and a 12-month high of $11.74. The company has a fifty day moving average price of $10.21 and a 200-day moving average price of $9.52. The firm has a market capitalization of $1.02 billion, a PE ratio of -6.55 and a beta of 1.22.

Wall Street Analyst Weigh In

Separately, Raymond James reiterated a "strong-buy" rating on shares of Skeena Resources in a research report on Friday.

Get Our Latest Stock Report on SKE

About Skeena Resources

(

Free Report)

Skeena Resources Limited explores for and develops mineral properties in Canada. The company explores for gold, silver, copper, and other precious metal deposits. It holds 100% interests in the Snip gold mine comprising one mining lease and nine mineral tenures that covers an area of approximately 4,724 hectares; and the Eskay Creek gold mine that consists of eight mineral leases, two surface leases, and various unpatented mining claims comprising 7,666 hectares located in British Columbia, Canada.

See Also

Before you consider Skeena Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skeena Resources wasn't on the list.

While Skeena Resources currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.