Raymond James Financial Inc. purchased a new position in Capital Southwest Co. (NASDAQ:CSWC - Free Report) during the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 194,755 shares of the asset manager's stock, valued at approximately $4,250,000. Raymond James Financial Inc. owned about 0.41% of Capital Southwest as of its most recent filing with the Securities and Exchange Commission (SEC).

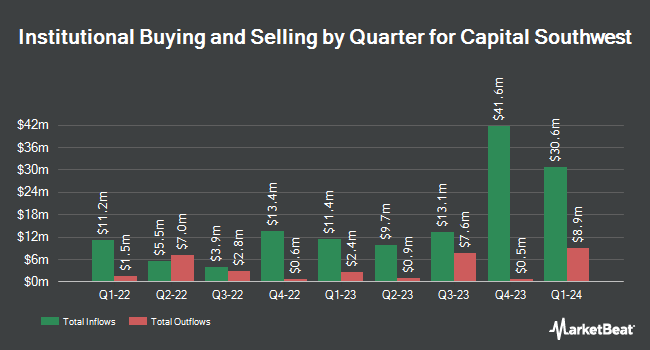

A number of other hedge funds also recently bought and sold shares of CSWC. Sanders Morris Harris LLC increased its holdings in shares of Capital Southwest by 28.0% in the 4th quarter. Sanders Morris Harris LLC now owns 814,584 shares of the asset manager's stock worth $17,579,000 after buying an additional 178,420 shares during the last quarter. Benjamin Edwards Inc. grew its position in Capital Southwest by 970.6% in the third quarter. Benjamin Edwards Inc. now owns 80,201 shares of the asset manager's stock worth $2,028,000 after acquiring an additional 72,710 shares in the last quarter. Tectonic Advisors LLC increased its stake in Capital Southwest by 21.0% during the fourth quarter. Tectonic Advisors LLC now owns 398,008 shares of the asset manager's stock worth $8,685,000 after acquiring an additional 69,174 shares during the last quarter. MML Investors Services LLC raised its position in Capital Southwest by 124.2% during the third quarter. MML Investors Services LLC now owns 102,730 shares of the asset manager's stock valued at $2,598,000 after purchasing an additional 56,919 shares during the period. Finally, Van ECK Associates Corp lifted its stake in shares of Capital Southwest by 3.3% in the 4th quarter. Van ECK Associates Corp now owns 1,190,204 shares of the asset manager's stock valued at $25,970,000 after purchasing an additional 38,051 shares during the last quarter. Hedge funds and other institutional investors own 23.42% of the company's stock.

Capital Southwest Trading Down 1.3 %

Shares of CSWC stock traded down $0.29 during trading hours on Friday, reaching $22.37. 611,741 shares of the stock were exchanged, compared to its average volume of 380,171. The firm has a market capitalization of $1.13 billion, a price-to-earnings ratio of 15.87 and a beta of 1.21. Capital Southwest Co. has a 12-month low of $20.68 and a 12-month high of $27.23. The company's 50-day moving average price is $22.70 and its 200-day moving average price is $23.25. The company has a current ratio of 0.18, a quick ratio of 0.18 and a debt-to-equity ratio of 0.64.

Capital Southwest (NASDAQ:CSWC - Get Free Report) last released its earnings results on Monday, February 3rd. The asset manager reported $0.63 EPS for the quarter, beating analysts' consensus estimates of $0.62 by $0.01. Capital Southwest had a return on equity of 15.18% and a net margin of 33.49%. As a group, equities analysts anticipate that Capital Southwest Co. will post 2.54 earnings per share for the current year.

Capital Southwest Cuts Dividend

The firm also recently announced a quarterly dividend, which will be paid on Monday, March 31st. Stockholders of record on Friday, March 14th will be given a dividend of $0.58 per share. The ex-dividend date of this dividend is Friday, March 14th. This represents a $2.32 annualized dividend and a dividend yield of 10.37%. Capital Southwest's dividend payout ratio (DPR) is 164.54%.

Wall Street Analyst Weigh In

Separately, StockNews.com downgraded Capital Southwest from a "hold" rating to a "sell" rating in a research report on Monday, March 24th.

Check Out Our Latest Analysis on CSWC

About Capital Southwest

(

Free Report)

Capital Southwest Corporation is a business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

See Also

Before you consider Capital Southwest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capital Southwest wasn't on the list.

While Capital Southwest currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.