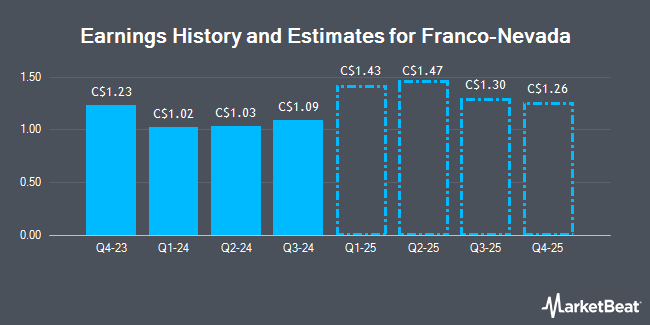

Franco-Nevada Co. (TSE:FNV - Free Report) NYSE: FNV - Research analysts at Raymond James raised their Q1 2025 EPS estimates for shares of Franco-Nevada in a note issued to investors on Thursday, December 19th. Raymond James analyst B. Macarthur now anticipates that the company will post earnings per share of $1.35 for the quarter, up from their prior forecast of $1.18. The consensus estimate for Franco-Nevada's current full-year earnings is $3.11 per share. Raymond James also issued estimates for Franco-Nevada's Q2 2025 earnings at $1.28 EPS, Q3 2025 earnings at $1.36 EPS, Q4 2025 earnings at $1.42 EPS and FY2025 earnings at $5.40 EPS.

Other research analysts have also issued reports about the stock. Stifel Nicolaus raised their target price on shares of Franco-Nevada from C$200.00 to C$215.00 in a research note on Monday, October 21st. CIBC raised their target price on Franco-Nevada from C$235.00 to C$245.00 in a report on Monday, December 2nd. UBS Group upgraded Franco-Nevada to a "strong-buy" rating in a report on Monday, November 18th. Finally, Canaccord Genuity Group dropped their target price on shares of Franco-Nevada from C$198.00 to C$190.00 and set a "strong-buy" rating on the stock in a research report on Monday, November 18th. Two investment analysts have rated the stock with a hold rating, five have given a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat, Franco-Nevada presently has an average rating of "Buy" and an average price target of C$190.80.

Read Our Latest Stock Analysis on Franco-Nevada

Franco-Nevada Stock Up 1.2 %

Shares of TSE FNV traded up C$1.94 during trading hours on Monday, hitting C$168.86. The stock had a trading volume of 139,781 shares, compared to its average volume of 327,424. The company has a market capitalization of C$32.49 billion, a P/E ratio of -40.30, a P/E/G ratio of 5.00 and a beta of 0.68. The firm's 50-day moving average price is C$173.84 and its two-hundred day moving average price is C$169.64. Franco-Nevada has a 52 week low of C$140.59 and a 52 week high of C$191.17. The company has a debt-to-equity ratio of 1.63, a quick ratio of 23.26 and a current ratio of 29.11.

Franco-Nevada Cuts Dividend

The business also recently declared a quarterly dividend, which was paid on Thursday, December 19th. Shareholders of record on Thursday, December 5th were paid a $0.487 dividend. This represents a $1.95 dividend on an annualized basis and a yield of 1.15%. The ex-dividend date of this dividend was Thursday, December 5th. Franco-Nevada's payout ratio is currently -46.30%.

Franco-Nevada Company Profile

(

Get Free Report)

Franco-Nevada Corporation operates as a gold-focused royalty and streaming company in South America, Central America, Mexico, the United States, Canada, and internationally. It operates through Mining and Energy segments. The company manages its portfolio with a focus on precious metals, such as gold, silver, and platinum group metals; and engages in the sale of crude oil, natural gas, and natural gas liquids through a third-party marketing agent.

See Also

Before you consider Franco-Nevada, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Franco-Nevada wasn't on the list.

While Franco-Nevada currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.