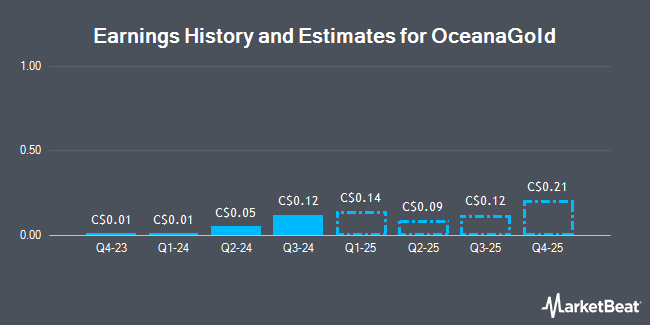

OceanaGold Co. (TSE:OGC - Free Report) - Stock analysts at Raymond James decreased their Q1 2025 earnings per share (EPS) estimates for shares of OceanaGold in a note issued to investors on Thursday, December 12th. Raymond James analyst F. Hamed now anticipates that the company will post earnings per share of $0.14 for the quarter, down from their prior estimate of $0.15. The consensus estimate for OceanaGold's current full-year earnings is $0.63 per share. Raymond James also issued estimates for OceanaGold's Q2 2025 earnings at $0.11 EPS, Q3 2025 earnings at $0.10 EPS, Q4 2025 earnings at $0.10 EPS and FY2025 earnings at $0.45 EPS.

OceanaGold (TSE:OGC - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported C$0.12 earnings per share for the quarter, missing the consensus estimate of C$0.14 by C($0.02). The company had revenue of C$470.93 million during the quarter. OceanaGold had a net margin of 0.10% and a return on equity of 0.24%.

Other analysts have also issued reports about the company. National Bankshares decreased their target price on OceanaGold from C$6.00 to C$5.50 and set an "outperform" rating for the company in a research report on Wednesday, October 23rd. Royal Bank of Canada increased their target price on OceanaGold from C$5.50 to C$6.00 in a report on Friday, December 6th. Scotiabank upped their price objective on shares of OceanaGold from C$4.75 to C$6.00 in a report on Thursday, November 21st. Finally, CIBC lowered their target price on shares of OceanaGold from C$6.00 to C$5.75 in a report on Friday. Five research analysts have rated the stock with a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, OceanaGold currently has a consensus rating of "Buy" and a consensus price target of C$5.10.

Check Out Our Latest Stock Analysis on OGC

OceanaGold Stock Down 0.5 %

OGC traded down C$0.02 during midday trading on Monday, hitting C$4.06. The company had a trading volume of 1,083,621 shares, compared to its average volume of 1,473,564. The company has a market capitalization of C$2.89 billion, a price-to-earnings ratio of 408.00 and a beta of 1.62. The stock's 50 day moving average price is C$4.08 and its 200 day moving average price is C$3.65. OceanaGold has a 52 week low of C$2.08 and a 52 week high of C$4.57.

OceanaGold Company Profile

(

Get Free Report)

OceanaGold Corporation, a gold and copper producer, engages in exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand. It explores for gold, copper, and silver deposits. OceanaGold Corporation was founded in 2003 and is based in Vancouver, Canada.

See Also

Before you consider OceanaGold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OceanaGold wasn't on the list.

While OceanaGold currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.