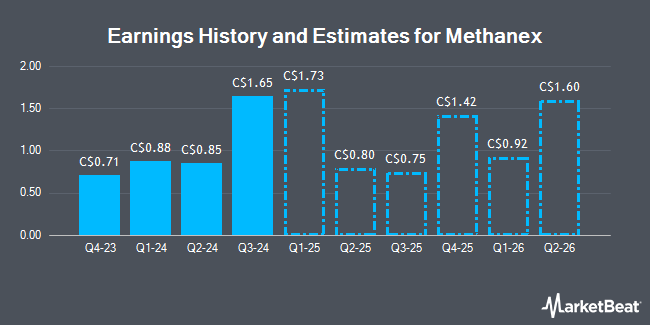

Methanex Co. (TSE:MX - Free Report) NASDAQ: MEOH - Equities researchers at Raymond James lifted their Q4 2024 EPS estimates for Methanex in a research report issued on Tuesday, January 14th. Raymond James analyst S. Hansen now forecasts that the company will post earnings of $1.68 per share for the quarter, up from their prior forecast of $1.50. The consensus estimate for Methanex's current full-year earnings is $5.95 per share. Raymond James also issued estimates for Methanex's Q1 2025 earnings at $2.25 EPS, Q2 2025 earnings at $1.34 EPS, Q4 2025 earnings at $2.66 EPS, FY2025 earnings at $7.69 EPS and FY2026 earnings at $8.81 EPS.

Methanex (TSE:MX - Get Free Report) NASDAQ: MEOH last announced its earnings results on Wednesday, November 6th. The company reported C$1.65 earnings per share for the quarter, topping the consensus estimate of C$0.60 by C$1.05. The business had revenue of C$1.28 billion during the quarter, compared to the consensus estimate of C$1.26 billion. Methanex had a net margin of 4.06% and a return on equity of 10.21%.

Separately, Cibc World Mkts upgraded shares of Methanex from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, December 10th.

View Our Latest Stock Report on Methanex

Methanex Stock Performance

Shares of Methanex stock traded down C$0.52 during trading hours on Friday, hitting C$71.32. 106,614 shares of the company were exchanged, compared to its average volume of 123,384. The business has a 50-day moving average of C$66.86 and a 200-day moving average of C$62.40. Methanex has a 1 year low of C$49.21 and a 1 year high of C$74.25. The company has a current ratio of 1.25, a quick ratio of 1.59 and a debt-to-equity ratio of 131.58. The stock has a market capitalization of C$4.81 billion, a price-to-earnings ratio of 24.51, a P/E/G ratio of 0.44 and a beta of 1.79.

Insider Buying and Selling at Methanex

In other news, Senior Officer Priscilla Fuchslocher sold 7,720 shares of the company's stock in a transaction on Monday, December 16th. The shares were sold at an average price of C$65.39, for a total transaction of C$504,818.52. 0.35% of the stock is owned by corporate insiders.

About Methanex

(

Get Free Report)

Methanex Corporation produces and supplies methanol in China, Europe, the United States, South America, South Korea, Canada, and Asia. The company also purchases methanol produced by others under methanol offtake contracts and on the spot market. In addition, it owns and leases storage and terminal facilities.

Featured Stories

Before you consider Methanex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Methanex wasn't on the list.

While Methanex currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.