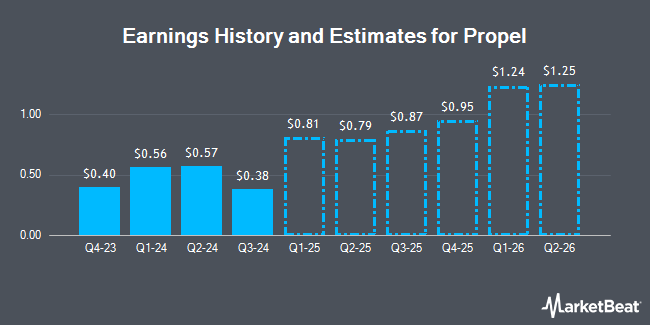

Propel Holdings Inc. (TSE:PRL - Free Report) - Analysts at Raymond James raised their Q4 2024 earnings per share estimates for Propel in a report released on Wednesday, November 6th. Raymond James analyst S. Boland now expects that the company will post earnings per share of $0.78 for the quarter, up from their previous estimate of $0.64. The consensus estimate for Propel's current full-year earnings is $5.39 per share. Raymond James also issued estimates for Propel's Q2 2025 earnings at $0.64 EPS and Q3 2025 earnings at $0.81 EPS.

Propel (TSE:PRL - Get Free Report) last posted its quarterly earnings data on Wednesday, August 7th. The company reported $0.57 EPS for the quarter, topping the consensus estimate of $0.56 by $0.01. The firm had revenue of $146.06 million during the quarter, compared to analyst estimates of $137.00 million. Propel had a return on equity of 36.84% and a net margin of 10.17%.

PRL has been the subject of several other reports. Ventum Financial set a C$38.00 target price on shares of Propel and gave the stock a "buy" rating in a report on Wednesday, October 9th. Eight Capital increased their price objective on shares of Propel from C$38.00 to C$45.00 in a research note on Friday. Canaccord Genuity Group upgraded shares of Propel to a "strong-buy" rating in a research note on Friday, October 4th. Scotiabank upgraded Propel from a "sector perform" rating to an "outperform" rating and increased their price target for the stock from C$28.00 to C$34.00 in a research note on Friday, October 4th. Finally, Ventum Cap Mkts upgraded Propel to a "strong-buy" rating in a research report on Tuesday, October 8th.

Read Our Latest Report on Propel

Propel Stock Up 0.2 %

TSE:PRL traded up $0.08 during mid-day trading on Friday, hitting $39.74. 231,996 shares of the company traded hands, compared to its average volume of 90,645. The stock's fifty day moving average price is $31.32 and its 200-day moving average price is $24.90. The firm has a market cap of $1.37 billion, a price-to-earnings ratio of 28.27 and a beta of 1.75. Propel has a one year low of $8.19 and a one year high of $40.88.

Propel Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 4th. Shareholders of record on Wednesday, December 4th will be paid a $0.15 dividend. The ex-dividend date of this dividend is Friday, November 15th. This represents a $0.60 annualized dividend and a yield of 1.51%. This is a boost from Propel's previous quarterly dividend of $0.14. Propel's payout ratio is presently 39.16%.

About Propel

(

Get Free Report)

Propel Holdings Inc operates as a financial technology company. The company's lending platform facilitates to credit products, such as installment loans and lines of credit under the MoneyKey, CreditFresh, and Fora Credit brands to American consumers. It also offers marketing, analytics, and loan servicing services.

Recommended Stories

Before you consider Propel, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Propel wasn't on the list.

While Propel currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.