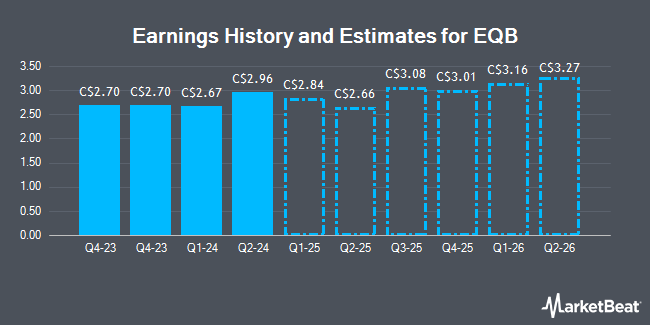

EQB Inc. (TSE:EQB - Free Report) - Research analysts at Raymond James lowered their Q3 2025 EPS estimates for EQB in a report released on Wednesday, February 26th. Raymond James analyst S. Boland now expects that the company will post earnings per share of $2.97 for the quarter, down from their previous forecast of $3.15. Raymond James has a "Outperform" rating and a $121.00 price target on the stock. The consensus estimate for EQB's current full-year earnings is $12.60 per share. Raymond James also issued estimates for EQB's Q3 2025 earnings at $2.97 EPS and Q4 2025 earnings at $3.06 EPS.

Other analysts have also recently issued reports about the company. BMO Capital Markets raised their price target on EQB from C$106.00 to C$119.00 in a research note on Monday, November 18th. Scotiabank dropped their price objective on EQB from C$130.00 to C$119.00 and set an "outperform" rating on the stock in a report on Thursday, February 20th. Desjardins decreased their target price on EQB from C$130.00 to C$126.00 and set a "buy" rating for the company in a research note on Thursday, February 27th. Jefferies Financial Group set a C$129.00 price target on shares of EQB and gave the company a "buy" rating in a research note on Thursday, January 30th. Finally, CIBC boosted their price objective on shares of EQB from C$113.00 to C$130.00 in a research report on Tuesday, November 26th. Two equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of C$122.80.

Read Our Latest Report on EQB

EQB Price Performance

Shares of EQB traded down C$2.94 during midday trading on Friday, reaching C$97.58. The stock had a trading volume of 147,325 shares, compared to its average volume of 67,699. The company has a market cap of C$3.77 billion, a price-to-earnings ratio of 15.21, a PEG ratio of 0.34 and a beta of 1.59. The company's fifty day simple moving average is C$105.35 and its two-hundred day simple moving average is C$104.02. EQB has a 1-year low of C$78.24 and a 1-year high of C$114.22.

EQB Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Shareholders of record on Monday, March 31st will be given a dividend of $0.51 per share. This is an increase from EQB's previous quarterly dividend of $0.49. This represents a $2.04 annualized dividend and a yield of 2.09%. The ex-dividend date is Friday, March 14th. EQB's dividend payout ratio (DPR) is presently 29.31%.

EQB Company Profile

(

Get Free Report)

EQB Inc formerly Equitable Group Inc trades on the Toronto Stock Exchange TSX: EQB and EQB.PR.C and serves over 360000 Canadians through its wholly owned subsidiary Equitable Bank Canadas Challenger Bank. Equitable Bank has grown to become the countrys eighth largest independent Schedule I bank with a clear mandate to drive real change in Canadian banking to enrich peoples lives.

Featured Articles

Before you consider EQB, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EQB wasn't on the list.

While EQB currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.