Halliburton (NYSE:HAL - Get Free Report) had its price objective lowered by equities research analysts at Raymond James from $41.00 to $37.00 in a research note issued to investors on Friday,Benzinga reports. The firm currently has a "strong-buy" rating on the oilfield services company's stock. Raymond James' price objective points to a potential upside of 26.63% from the company's previous close.

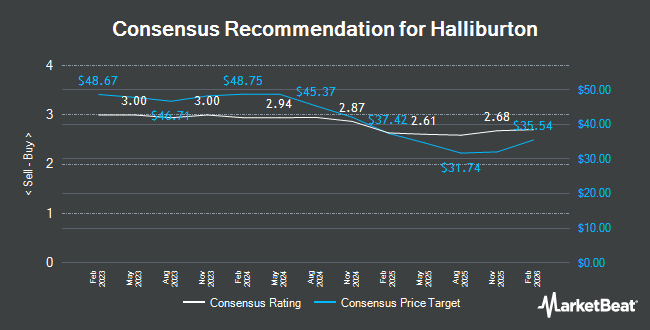

A number of other research analysts have also weighed in on the stock. Jefferies Financial Group cut their target price on shares of Halliburton from $47.00 to $46.00 and set a "buy" rating for the company in a report on Tuesday, September 24th. TD Cowen dropped their price objective on shares of Halliburton from $47.00 to $45.00 and set a "buy" rating for the company in a research note on Monday, July 22nd. Benchmark restated a "buy" rating and set a $40.00 target price on shares of Halliburton in a research report on Friday. Dbs Bank began coverage on Halliburton in a research note on Wednesday, September 18th. They issued a "buy" rating and a $45.00 price objective for the company. Finally, BMO Capital Markets cut their target price on Halliburton from $40.00 to $38.00 and set a "market perform" rating on the stock in a research report on Thursday, October 10th. Four analysts have rated the stock with a hold rating, sixteen have issued a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Halliburton presently has a consensus rating of "Moderate Buy" and a consensus price target of $40.79.

View Our Latest Stock Analysis on HAL

Halliburton Price Performance

NYSE HAL traded down $0.33 on Friday, reaching $29.22. The company had a trading volume of 9,739,774 shares, compared to its average volume of 8,047,481. The firm's 50 day moving average price is $29.10 and its 200 day moving average price is $32.53. Halliburton has a 12 month low of $27.26 and a 12 month high of $41.56. The stock has a market capitalization of $25.80 billion, a PE ratio of 9.71, a price-to-earnings-growth ratio of 1.85 and a beta of 1.89. The company has a quick ratio of 1.54, a current ratio of 2.13 and a debt-to-equity ratio of 0.76.

Halliburton (NYSE:HAL - Get Free Report) last posted its earnings results on Thursday, November 7th. The oilfield services company reported $0.73 EPS for the quarter, missing analysts' consensus estimates of $0.75 by ($0.02). The firm had revenue of $5.70 billion during the quarter, compared to analysts' expectations of $5.83 billion. Halliburton had a return on equity of 29.97% and a net margin of 11.61%. Halliburton's quarterly revenue was down 1.8% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.79 earnings per share. As a group, equities analysts predict that Halliburton will post 3.12 earnings per share for the current year.

Institutional Investors Weigh In On Halliburton

Several large investors have recently modified their holdings of HAL. Price T Rowe Associates Inc. MD lifted its holdings in Halliburton by 46.0% during the first quarter. Price T Rowe Associates Inc. MD now owns 61,090,055 shares of the oilfield services company's stock worth $2,408,171,000 after buying an additional 19,237,784 shares during the period. Pacer Advisors Inc. boosted its position in Halliburton by 17,317.6% during the second quarter. Pacer Advisors Inc. now owns 13,631,188 shares of the oilfield services company's stock valued at $460,462,000 after purchasing an additional 13,552,927 shares in the last quarter. LSV Asset Management grew its stake in Halliburton by 24,954.1% in the second quarter. LSV Asset Management now owns 2,730,900 shares of the oilfield services company's stock valued at $92,250,000 after purchasing an additional 2,720,000 shares during the last quarter. Vanguard Group Inc. raised its holdings in Halliburton by 2.7% in the first quarter. Vanguard Group Inc. now owns 100,274,105 shares of the oilfield services company's stock worth $3,952,805,000 after purchasing an additional 2,618,740 shares in the last quarter. Finally, Dimensional Fund Advisors LP lifted its position in shares of Halliburton by 20.0% during the second quarter. Dimensional Fund Advisors LP now owns 10,087,115 shares of the oilfield services company's stock valued at $340,752,000 after buying an additional 1,681,620 shares during the last quarter. Institutional investors own 85.23% of the company's stock.

About Halliburton

(

Get Free Report)

Halliburton Company provides products and services to the energy industry worldwide. It operates through two segments, Completion and Production, and Drilling and Evaluation. The Completion and Production segment offers production enhancement services that include stimulation and sand control services; cementing services, such as well bonding and casing, and casing equipment; and completion tools that offer downhole solutions and services, including well completion products and services, intelligent well completions, and service tools, as well as liner hanger, sand control, and multilateral systems.

See Also

Before you consider Halliburton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halliburton wasn't on the list.

While Halliburton currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.