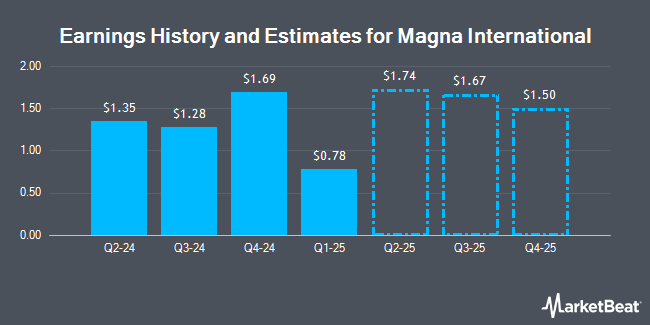

Magna International Inc. (NYSE:MGA - Free Report) TSE: MG - Research analysts at Raymond James cut their Q4 2024 earnings estimates for shares of Magna International in a note issued to investors on Monday, November 4th. Raymond James analyst M. Glen now expects that the company will earn $1.35 per share for the quarter, down from their prior estimate of $1.49. Raymond James has a "Market Perform" rating and a $53.00 price objective on the stock. The consensus estimate for Magna International's current full-year earnings is $5.30 per share.

A number of other research firms have also recently weighed in on MGA. Barclays dropped their target price on shares of Magna International from $55.00 to $50.00 and set an "equal weight" rating on the stock in a research note on Tuesday, August 6th. The Goldman Sachs Group dropped their price objective on Magna International from $44.00 to $41.00 and set a "neutral" rating on the stock in a research note on Tuesday, October 1st. Evercore lowered their target price on Magna International from $60.00 to $50.00 and set an "in-line" rating on the stock in a research note on Monday, July 15th. Royal Bank of Canada cut their price target on Magna International from $42.00 to $41.00 and set a "sector perform" rating for the company in a research note on Monday. Finally, BMO Capital Markets lowered their price objective on Magna International from $60.00 to $55.00 and set an "outperform" rating on the stock in a research note on Monday, July 22nd. One investment analyst has rated the stock with a sell rating, thirteen have issued a hold rating and six have given a buy rating to the company. According to data from MarketBeat, Magna International has an average rating of "Hold" and a consensus target price of $49.76.

View Our Latest Stock Analysis on Magna International

Magna International Stock Performance

Shares of NYSE MGA traded down $0.45 during mid-day trading on Wednesday, reaching $42.13. 2,038,538 shares of the company's stock were exchanged, compared to its average volume of 1,432,537. The firm has a market capitalization of $12.11 billion, a price-to-earnings ratio of 11.26, a price-to-earnings-growth ratio of 0.68 and a beta of 1.59. The firm has a 50-day moving average price of $41.33 and a two-hundred day moving average price of $43.03. The company has a debt-to-equity ratio of 0.39, a current ratio of 1.14 and a quick ratio of 0.77. Magna International has a 52 week low of $38.01 and a 52 week high of $60.32.

Magna International (NYSE:MGA - Get Free Report) TSE: MG last issued its quarterly earnings results on Friday, November 1st. The company reported $1.28 EPS for the quarter, missing analysts' consensus estimates of $1.48 by ($0.20). Magna International had a net margin of 2.52% and a return on equity of 11.88%. The business had revenue of $10.28 billion for the quarter, compared to analysts' expectations of $10.34 billion. During the same period in the previous year, the business posted $1.46 earnings per share. The business's revenue was down 3.8% compared to the same quarter last year.

Magna International Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, November 29th. Stockholders of record on Friday, November 15th will be issued a $0.475 dividend. This represents a $1.90 dividend on an annualized basis and a dividend yield of 4.51%. The ex-dividend date of this dividend is Friday, November 15th. Magna International's payout ratio is 50.80%.

Institutional Inflows and Outflows

A number of institutional investors have recently added to or reduced their stakes in the company. Kennebec Savings Bank purchased a new position in shares of Magna International in the 3rd quarter worth about $32,000. Van ECK Associates Corp boosted its stake in Magna International by 6.6% in the third quarter. Van ECK Associates Corp now owns 12,290 shares of the company's stock worth $517,000 after buying an additional 766 shares in the last quarter. Janney Montgomery Scott LLC grew its position in Magna International by 11.4% during the third quarter. Janney Montgomery Scott LLC now owns 210,632 shares of the company's stock valued at $8,644,000 after acquiring an additional 21,532 shares during the last quarter. Arkadios Wealth Advisors purchased a new position in shares of Magna International during the third quarter worth approximately $216,000. Finally, Forsta AP Fonden lifted its holdings in shares of Magna International by 20.3% in the 3rd quarter. Forsta AP Fonden now owns 84,300 shares of the company's stock worth $3,462,000 after acquiring an additional 14,200 shares during the last quarter. Institutional investors own 67.49% of the company's stock.

About Magna International

(

Get Free Report)

Magna International Inc designs, engineers, and manufactures components, assemblies, systems, subsystems, and modules for original equipment manufacturers of vehicles and light trucks worldwide. It operates through four segments: Body Exteriors & Structures, Power & Vision, Seating Systems, and Complete Vehicles.

Featured Articles

Before you consider Magna International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Magna International wasn't on the list.

While Magna International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.