Calibre Mining (TSE:CXB - Get Free Report) had its price target upped by equities research analysts at Raymond James from C$3.25 to C$4.00 in a research note issued on Friday,BayStreet.CA reports. Raymond James' price objective points to a potential upside of 40.85% from the company's current price.

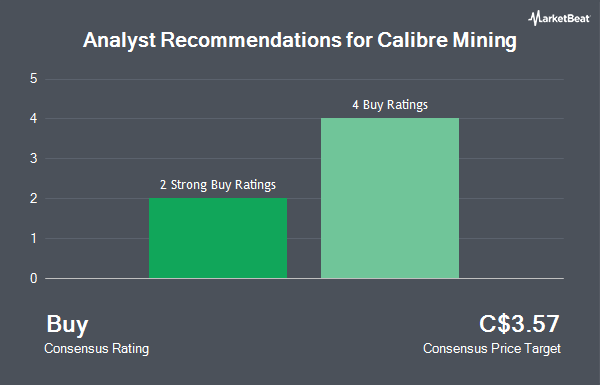

Other analysts have also issued reports about the company. National Bankshares boosted their price target on Calibre Mining from C$3.40 to C$4.00 and gave the company an "outperform" rating in a report on Tuesday, February 11th. Ventum Financial set a C$3.30 target price on Calibre Mining and gave the company a "buy" rating in a research note on Thursday, January 30th. Finally, Ventum Cap Mkts raised shares of Calibre Mining to a "strong-buy" rating in a research note on Friday, January 17th. Six research analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Buy" and an average target price of C$3.56.

Check Out Our Latest Research Report on CXB

Calibre Mining Stock Up 9.7 %

CXB traded up C$0.25 during trading on Friday, hitting C$2.84. The company had a trading volume of 7,549,895 shares, compared to its average volume of 3,098,610. The company has a market capitalization of C$1.71 billion, a PE ratio of 53.11 and a beta of 2.08. The company has a quick ratio of 0.97, a current ratio of 2.06 and a debt-to-equity ratio of 38.70. Calibre Mining has a one year low of C$1.73 and a one year high of C$3.34. The firm's 50-day moving average price is C$2.95 and its 200 day moving average price is C$2.61.

About Calibre Mining

(

Get Free Report)

Calibre Mining Corp is a multi-asset gold producer with a portfolio of exploration and development opportunities in Nicaragua. Its project includes Pavon Gold Project, Borosi Gold Project, IamGold and Santa Rita. The company has only one revenue stream, being the sale of refined gold from its operations in Nicaragua.

Featured Articles

Before you consider Calibre Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Calibre Mining wasn't on the list.

While Calibre Mining currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.