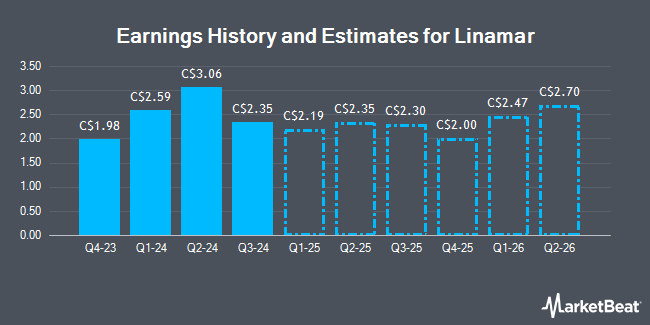

Linamar Co. (TSE:LNR - Free Report) - Investment analysts at Raymond James lifted their Q1 2025 earnings per share (EPS) estimates for shares of Linamar in a report released on Thursday, March 6th. Raymond James analyst M. Glen now anticipates that the company will post earnings per share of $2.19 for the quarter, up from their previous estimate of $2.05. The consensus estimate for Linamar's current full-year earnings is $11.43 per share. Raymond James also issued estimates for Linamar's Q2 2025 earnings at $2.35 EPS, Q3 2025 earnings at $2.30 EPS, Q4 2025 earnings at $2.00 EPS, FY2025 earnings at $8.84 EPS, Q1 2026 earnings at $2.36 EPS, Q2 2026 earnings at $2.54 EPS, Q3 2026 earnings at $2.54 EPS, Q4 2026 earnings at $2.24 EPS and FY2026 earnings at $9.68 EPS.

Other equities research analysts have also issued research reports about the company. BMO Capital Markets lowered their price objective on Linamar from C$75.00 to C$65.00 in a research report on Thursday, March 6th. CIBC downgraded shares of Linamar from an "outperform" rating to a "neutral" rating and lowered their price target for the stock from C$82.00 to C$55.00 in a report on Wednesday, March 5th. Cibc World Mkts cut shares of Linamar from a "strong-buy" rating to a "hold" rating in a report on Wednesday, March 5th. Finally, TD Securities lowered their target price on shares of Linamar from C$66.00 to C$60.00 and set a "hold" rating on the stock in a research note on Thursday, March 6th.

View Our Latest Report on Linamar

Linamar Stock Performance

Shares of LNR traded up C$0.55 during mid-day trading on Monday, reaching C$51.78. The company had a trading volume of 170,937 shares, compared to its average volume of 165,368. The stock has a 50 day moving average of C$54.67 and a two-hundred day moving average of C$58.86. The company has a quick ratio of 0.75, a current ratio of 1.79 and a debt-to-equity ratio of 42.84. The stock has a market capitalization of C$3.17 billion, a P/E ratio of 5.41, a PEG ratio of 1.12 and a beta of 1.41. Linamar has a 52-week low of C$47.17 and a 52-week high of C$73.84.

Insiders Place Their Bets

In other news, Director Linda Hasenfratz bought 50,000 shares of the firm's stock in a transaction dated Monday, December 16th. The shares were acquired at an average price of C$60.01 per share, for a total transaction of C$3,000,500.00. 33.49% of the stock is currently owned by company insiders.

About Linamar

(

Get Free Report)

Linamar Corporation, together with its subsidiaries, produces engineered products in Canada, Europe, the Asia Pacific, and rest of North America. It operates through two segments, Mobility and Industrial. The Mobility segment focuses on light metal casting, forging, machining, and assembly for electrified and powered vehicle markets.

Featured Articles

Before you consider Linamar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Linamar wasn't on the list.

While Linamar currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.