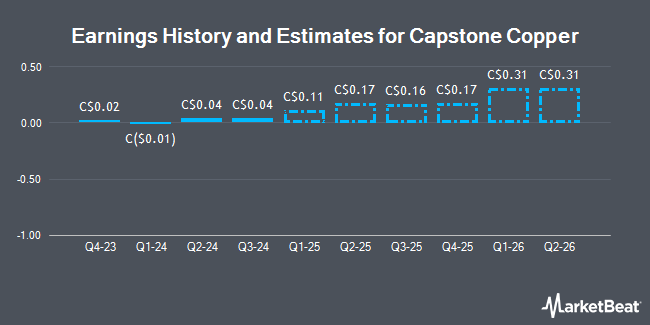

Capstone Copper Corp. (TSE:CS - Free Report) - Stock analysts at Raymond James reduced their FY2024 earnings per share (EPS) estimates for shares of Capstone Copper in a report issued on Monday, November 25th. Raymond James analyst F. Hamed now forecasts that the mining company will post earnings per share of $0.17 for the year, down from their prior forecast of $0.18. Raymond James has a "Outperform" rating and a $12.00 price target on the stock. The consensus estimate for Capstone Copper's current full-year earnings is $0.85 per share. Raymond James also issued estimates for Capstone Copper's Q4 2024 earnings at $0.10 EPS, Q1 2025 earnings at $0.18 EPS, Q2 2025 earnings at $0.19 EPS, Q3 2025 earnings at $0.19 EPS, Q4 2025 earnings at $0.21 EPS and FY2025 earnings at $0.78 EPS.

CS has been the topic of a number of other research reports. Eight Capital lifted their target price on shares of Capstone Copper from C$14.00 to C$15.00 in a research note on Friday. Canaccord Genuity Group dropped their price target on Capstone Copper from C$14.00 to C$12.50 in a research note on Monday. TD Securities increased their price objective on shares of Capstone Copper from C$12.00 to C$13.00 and gave the company a "buy" rating in a report on Wednesday, October 2nd. Royal Bank of Canada cut their price target on Capstone Copper from C$14.00 to C$12.00 and set an "outperform" rating for the company in a report on Tuesday, September 10th. Finally, Scotiabank lifted their price objective on shares of Capstone Copper from C$12.00 to C$13.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 2nd. Twelve investment analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company has an average rating of "Buy" and an average target price of C$12.84.

Read Our Latest Analysis on CS

Capstone Copper Stock Performance

Shares of Capstone Copper stock traded down C$0.22 during trading hours on Tuesday, reaching C$9.62. 1,938,379 shares of the stock traded hands, compared to its average volume of 2,253,177. Capstone Copper has a one year low of C$5.26 and a one year high of C$11.51. The firm has a market capitalization of C$7.24 billion, a price-to-earnings ratio of -46.10, a P/E/G ratio of -0.09 and a beta of 2.14. The company has a quick ratio of 0.98, a current ratio of 0.94 and a debt-to-equity ratio of 40.10. The company has a 50 day moving average price of C$10.17 and a 200 day moving average price of C$9.73.

Capstone Copper (TSE:CS - Get Free Report) last released its quarterly earnings data on Thursday, October 31st. The mining company reported C$0.04 earnings per share for the quarter, missing the consensus estimate of C$0.11 by C($0.07). Capstone Copper had a negative net margin of 1.47% and a negative return on equity of 1.24%. The company had revenue of C$572.14 million for the quarter, compared to analysts' expectations of C$612.00 million.

Insider Activity at Capstone Copper

In other news, Director Humberto Antonio Fernandois sold 29,906 shares of the business's stock in a transaction dated Monday, September 16th. The shares were sold at an average price of C$9.26, for a total transaction of C$276,977.41. Also, Director Darren Murvin Pylot sold 100,000 shares of the firm's stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of C$11.05, for a total transaction of C$1,104,990.00. Insiders sold 974,079 shares of company stock worth $10,016,304 over the last three months. Company insiders own 15.37% of the company's stock.

About Capstone Copper

(

Get Free Report)

Capstone Copper Corp. operates as a copper mining company in the United States, Chile, and Mexico. It primarily explores for copper, silver, zinc, and other metals. The company owns 100% interests in Pinto Valley copper mine located in the Arizona, the United States; Mantos Blancos copper-silver mine located in the Region of Antofagasta, Chile; Santo Domingo copper-iron-gold-cobalt project located in the Atacama region, Chile; and Cozamin copper-silver mine located in the Zacatecas, Mexico.

Featured Stories

Before you consider Capstone Copper, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Capstone Copper wasn't on the list.

While Capstone Copper currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.