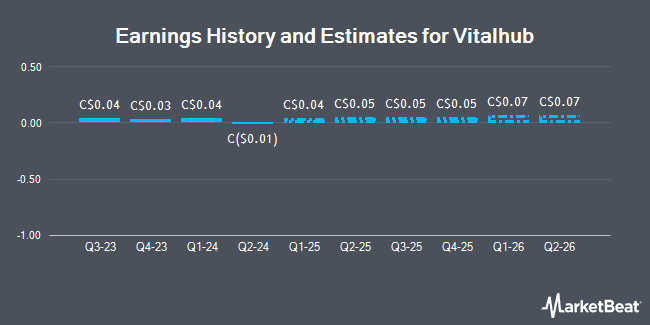

Vitalhub Corp. (TSE:VHI - Free Report) - Stock analysts at Raymond James issued their FY2024 EPS estimates for shares of Vitalhub in a report issued on Wednesday, March 26th. Raymond James analyst M. Freeman forecasts that the company will post earnings per share of $0.06 for the year. Raymond James currently has a "Moderate Buy" rating on the stock. The consensus estimate for Vitalhub's current full-year earnings is $0.23 per share. Raymond James also issued estimates for Vitalhub's Q4 2024 earnings at $0.02 EPS, Q1 2025 earnings at $0.04 EPS, Q2 2025 earnings at $0.05 EPS, Q3 2025 earnings at $0.06 EPS, Q4 2025 earnings at $0.06 EPS, FY2025 earnings at $0.21 EPS, Q1 2026 earnings at $0.07 EPS, Q2 2026 earnings at $0.07 EPS, Q3 2026 earnings at $0.08 EPS, Q4 2026 earnings at $0.09 EPS and FY2026 earnings at $0.31 EPS.

Several other analysts have also recently weighed in on the stock. TD Securities lifted their price objective on shares of Vitalhub from C$13.00 to C$14.00 and gave the stock a "buy" rating in a research note on Monday. Canaccord Genuity Group lifted their price target on shares of Vitalhub from C$12.00 to C$12.50 and gave the company a "buy" rating in a research report on Thursday, January 16th. Finally, Scotiabank set a C$14.00 price target on Vitalhub and gave the stock an "outperform" rating in a research report on Thursday, January 30th. Five analysts have rated the stock with a buy rating, According to MarketBeat, Vitalhub presently has an average rating of "Buy" and a consensus target price of C$12.08.

Check Out Our Latest Research Report on VHI

Vitalhub Stock Down 3.1 %

Shares of Vitalhub stock traded down C$0.31 during trading on Monday, reaching C$9.70. The company's stock had a trading volume of 150,673 shares, compared to its average volume of 145,488. The business's 50-day moving average price is C$10.34 and its 200-day moving average price is C$10.36. Vitalhub has a 52 week low of C$5.80 and a 52 week high of C$12.09. The firm has a market cap of C$524.70 million, a PE ratio of 157.77, a P/E/G ratio of 1.18 and a beta of 1.26.

About Vitalhub

(

Get Free Report)

Vitalhub Corp., together with its subsidiaries, provides technology solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally. Its solutions include electronic healthcare record, case management, care coordination and optimization, and patient flow, engagement, and operational visibility solutions.

Featured Articles

Before you consider Vitalhub, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vitalhub wasn't on the list.

While Vitalhub currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.