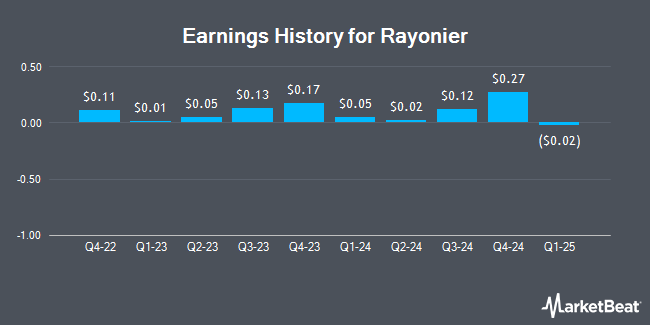

Rayonier (NYSE:RYN - Get Free Report) announced its earnings results on Wednesday. The real estate investment trust reported $0.12 EPS for the quarter, missing the consensus estimate of $0.13 by ($0.01), Briefing.com reports. Rayonier had a return on equity of 3.00% and a net margin of 14.78%. The business had revenue of $195.00 million for the quarter, compared to the consensus estimate of $211.21 million. During the same quarter in the previous year, the company posted $0.13 EPS. Rayonier's revenue for the quarter was down 3.3% on a year-over-year basis. Rayonier updated its FY24 guidance to $0.36-0.40 EPS and its FY 2024 guidance to 0.360-0.400 EPS.

Rayonier Trading Up 0.8 %

NYSE RYN traded up $0.26 on Thursday, reaching $31.73. The company had a trading volume of 411,729 shares, compared to its average volume of 593,726. The company has a quick ratio of 1.78, a current ratio of 1.98 and a debt-to-equity ratio of 0.75. Rayonier has a 52 week low of $27.40 and a 52 week high of $35.29. The stock has a market cap of $4.73 billion, a price-to-earnings ratio of 31.47 and a beta of 1.05. The stock's 50 day moving average is $31.52 and its 200-day moving average is $30.30.

Rayonier Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Tuesday, December 17th will be given a $0.285 dividend. The ex-dividend date of this dividend is Tuesday, December 17th. This represents a $1.14 annualized dividend and a dividend yield of 3.59%. Rayonier's dividend payout ratio is currently 114.00%.

Insiders Place Their Bets

In other news, Director V. Larkin Martin sold 10,011 shares of the company's stock in a transaction dated Wednesday, September 11th. The stock was sold at an average price of $30.57, for a total value of $306,036.27. Following the completion of the sale, the director now directly owns 40,168 shares of the company's stock, valued at $1,227,935.76. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Company insiders own 0.83% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts have commented on RYN shares. StockNews.com raised shares of Rayonier from a "sell" rating to a "hold" rating in a report on Saturday, August 17th. Truist Financial increased their price target on shares of Rayonier from $31.00 to $32.00 and gave the company a "hold" rating in a research note on Tuesday, October 15th.

Check Out Our Latest Research Report on Rayonier

Rayonier Company Profile

(

Get Free Report)

Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of December 31, 2023, Rayonier owned or leased under long-term agreements approximately 2.7 million acres of timberlands located in the U.S.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rayonier, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rayonier wasn't on the list.

While Rayonier currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.