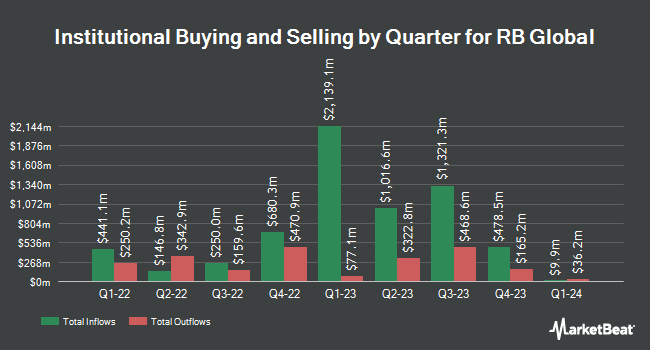

Eagle Asset Management Inc. decreased its holdings in RB Global, Inc. (NYSE:RBA - Free Report) TSE: RBA by 12.3% in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 2,581,467 shares of the business services provider's stock after selling 362,624 shares during the quarter. RB Global accounts for approximately 1.1% of Eagle Asset Management Inc.'s holdings, making the stock its 9th biggest holding. Eagle Asset Management Inc. owned 1.40% of RB Global worth $207,782,000 at the end of the most recent quarter.

Several other institutional investors have also made changes to their positions in RBA. EdgePoint Investment Group Inc. raised its stake in RB Global by 1.4% during the first quarter. EdgePoint Investment Group Inc. now owns 8,564,254 shares of the business services provider's stock worth $652,590,000 after acquiring an additional 114,225 shares in the last quarter. Cooke & Bieler LP lifted its holdings in RB Global by 3.4% during the 2nd quarter. Cooke & Bieler LP now owns 3,311,490 shares of the business services provider's stock valued at $252,865,000 after purchasing an additional 109,056 shares during the last quarter. Fiera Capital Corp boosted its position in RB Global by 5.7% in the second quarter. Fiera Capital Corp now owns 3,143,924 shares of the business services provider's stock valued at $239,881,000 after buying an additional 168,945 shares in the last quarter. Boston Partners grew its stake in RB Global by 4.1% during the first quarter. Boston Partners now owns 3,029,758 shares of the business services provider's stock worth $230,543,000 after buying an additional 120,469 shares during the last quarter. Finally, Canoe Financial LP increased its holdings in shares of RB Global by 22.0% during the third quarter. Canoe Financial LP now owns 1,418,666 shares of the business services provider's stock worth $113,900,000 after buying an additional 255,484 shares in the last quarter. 95.37% of the stock is currently owned by institutional investors and hedge funds.

Insider Activity

In related news, CEO James Francis Kessler sold 17,883 shares of the stock in a transaction dated Monday, September 23rd. The stock was sold at an average price of $84.19, for a total transaction of $1,505,569.77. Following the completion of the transaction, the chief executive officer now directly owns 86,247 shares in the company, valued at approximately $7,261,134.93. This trade represents a 17.17 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. 4.32% of the stock is currently owned by company insiders.

Analyst Ratings Changes

Several research analysts have recently commented on RBA shares. Bank of America boosted their target price on RB Global from $79.00 to $92.50 and gave the stock a "neutral" rating in a report on Monday, August 26th. Royal Bank of Canada increased their target price on RB Global from $99.00 to $107.00 and gave the stock an "outperform" rating in a report on Monday, November 11th. Raymond James lifted their price target on RB Global from $95.00 to $98.00 and gave the company an "outperform" rating in a report on Thursday, August 8th. BMO Capital Markets upped their price target on shares of RB Global from $105.00 to $107.00 and gave the stock an "outperform" rating in a research report on Monday, November 11th. Finally, Robert W. Baird raised their price objective on shares of RB Global from $86.00 to $100.00 and gave the company an "outperform" rating in a research report on Monday, November 11th. Two research analysts have rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $98.36.

Get Our Latest Stock Analysis on RBA

RB Global Trading Up 1.9 %

Shares of NYSE RBA traded up $1.81 during mid-day trading on Friday, hitting $97.15. The company's stock had a trading volume of 487,005 shares, compared to its average volume of 1,011,946. RB Global, Inc. has a one year low of $60.84 and a one year high of $97.30. The company's fifty day simple moving average is $85.30 and its 200-day simple moving average is $80.98. The company has a debt-to-equity ratio of 0.52, a current ratio of 1.28 and a quick ratio of 1.17. The stock has a market cap of $17.92 billion, a price-to-earnings ratio of 52.74, a price-to-earnings-growth ratio of 4.50 and a beta of 0.92.

RB Global Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Stockholders of record on Wednesday, November 27th will be given a dividend of $0.29 per share. The ex-dividend date of this dividend is Wednesday, November 27th. This represents a $1.16 annualized dividend and a dividend yield of 1.19%. RB Global's payout ratio is currently 63.04%.

RB Global Profile

(

Free Report)

RB Global, Inc, an omnichannel marketplace, provides insights, services, and transaction solutions for buyers and sellers of commercial assets and vehicles worldwide. Its marketplace brands include Ritchie Bros., an auctioneer of commercial assets and vehicles offering online bidding; IAA, a digital marketplace connecting vehicle buyers and sellers; Rouse Services, which provides asset management, data-driven intelligence, and performance benchmarking system; SmartEquip, a technology platform that supports customers' management of the equipment lifecycle; and Veritread, an online marketplace for heavy haul transport solution.

Read More

Before you consider RB Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RB Global wasn't on the list.

While RB Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.