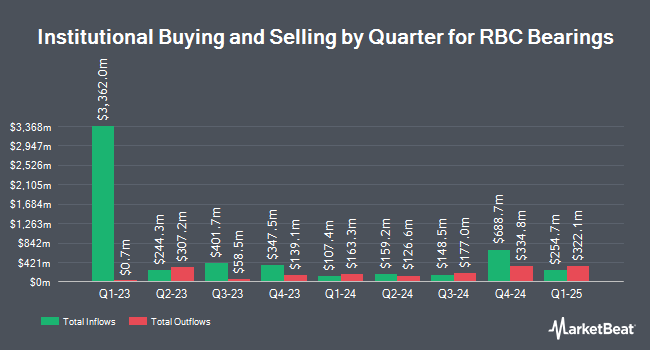

Commerce Bank lessened its stake in shares of RBC Bearings Incorporated (NYSE:RBC - Free Report) by 35.3% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,885 shares of the industrial products company's stock after selling 1,571 shares during the period. Commerce Bank's holdings in RBC Bearings were worth $864,000 at the end of the most recent reporting period.

A number of other hedge funds have also recently added to or reduced their stakes in the stock. Dimensional Fund Advisors LP increased its stake in shares of RBC Bearings by 22.7% in the 2nd quarter. Dimensional Fund Advisors LP now owns 347,030 shares of the industrial products company's stock valued at $93,626,000 after purchasing an additional 64,217 shares during the last quarter. American Century Companies Inc. increased its stake in shares of RBC Bearings by 30.4% in the 2nd quarter. American Century Companies Inc. now owns 206,630 shares of the industrial products company's stock valued at $55,745,000 after purchasing an additional 48,209 shares during the last quarter. Douglas Lane & Associates LLC increased its stake in shares of RBC Bearings by 123.9% in the 2nd quarter. Douglas Lane & Associates LLC now owns 81,862 shares of the industrial products company's stock valued at $22,085,000 after purchasing an additional 45,294 shares during the last quarter. Renaissance Technologies LLC bought a new position in shares of RBC Bearings in the 2nd quarter valued at $11,708,000. Finally, Millennium Management LLC increased its stake in shares of RBC Bearings by 313.5% in the 2nd quarter. Millennium Management LLC now owns 46,861 shares of the industrial products company's stock valued at $12,642,000 after purchasing an additional 35,529 shares during the last quarter.

Insider Transactions at RBC Bearings

In other news, CEO Michael J. Hartnett sold 503 shares of RBC Bearings stock in a transaction dated Wednesday, September 18th. The stock was sold at an average price of $289.00, for a total value of $145,367.00. Following the completion of the transaction, the chief executive officer now directly owns 322,588 shares of the company's stock, valued at approximately $93,227,932. This trade represents a 0.16 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, VP Richard J. Edwards sold 4,200 shares of RBC Bearings stock in a transaction dated Tuesday, August 27th. The stock was sold at an average price of $292.67, for a total value of $1,229,214.00. Following the completion of the transaction, the vice president now directly owns 12,539 shares of the company's stock, valued at approximately $3,669,789.13. This trade represents a 25.09 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 38,327 shares of company stock valued at $11,068,921. Corporate insiders own 2.60% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently issued reports on RBC shares. Bank of America lowered RBC Bearings from a "buy" rating to a "neutral" rating and lifted their price target for the company from $330.00 to $335.00 in a research note on Thursday. KeyCorp upgraded RBC Bearings from a "sector weight" rating to an "overweight" rating and set a $375.00 price target on the stock in a research note on Friday. Finally, Truist Financial raised their price objective on RBC Bearings from $315.00 to $347.00 and gave the company a "buy" rating in a report on Wednesday, November 20th. Four investment analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, RBC Bearings currently has an average rating of "Moderate Buy" and a consensus target price of $324.67.

View Our Latest Stock Analysis on RBC

RBC Bearings Price Performance

Shares of NYSE RBC traded up $2.03 during mid-day trading on Monday, hitting $338.85. 235,498 shares of the stock traded hands, compared to its average volume of 143,655. The company has a market cap of $10.64 billion, a PE ratio of 49.47, a price-to-earnings-growth ratio of 4.63 and a beta of 1.51. RBC Bearings Incorporated has a twelve month low of $240.36 and a twelve month high of $343.66. The firm has a 50 day simple moving average of $298.76 and a two-hundred day simple moving average of $289.10. The company has a debt-to-equity ratio of 0.38, a current ratio of 3.48 and a quick ratio of 1.28.

RBC Bearings (NYSE:RBC - Get Free Report) last announced its earnings results on Friday, November 1st. The industrial products company reported $2.29 EPS for the quarter, missing the consensus estimate of $2.30 by ($0.01). The company had revenue of $397.90 million for the quarter, compared to analyst estimates of $403.89 million. RBC Bearings had a return on equity of 9.88% and a net margin of 14.06%. The firm's quarterly revenue was up 3.2% compared to the same quarter last year. During the same period in the previous year, the firm posted $2.07 earnings per share. As a group, equities research analysts forecast that RBC Bearings Incorporated will post 8.94 EPS for the current fiscal year.

About RBC Bearings

(

Free Report)

RBC Bearings Incorporated manufactures and markets engineered precision bearings, components, and systems in the United States and internationally. It operates through two segments, Aerospace/Defense and Industrial. The company produces plain bearings with self-lubricating or metal-to-metal designs, including rod end bearings, spherical plain bearings, and journal bearings; roller bearings, such as tapered roller bearings, needle roller bearings, and needle bearing track rollers and cam followers, which are anti-friction products that are used in industrial applications and military aircraft platforms; and ball bearings include high precision aerospace, airframe control, thin section, and industrial ball bearings that utilize high precision ball elements to reduce friction in high-speed applications.

See Also

Before you consider RBC Bearings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RBC Bearings wasn't on the list.

While RBC Bearings currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.