RBC Bearings (NYSE:RBC - Free Report) had its price target raised by Morgan Stanley from $360.00 to $390.00 in a report released on Tuesday,Benzinga reports. Morgan Stanley currently has an overweight rating on the industrial products company's stock.

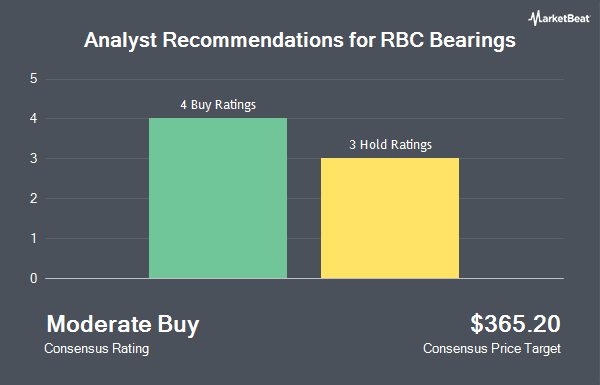

Several other brokerages also recently issued reports on RBC. KeyCorp lifted their price objective on RBC Bearings from $375.00 to $395.00 and gave the company an "overweight" rating in a research report on Monday. Bank of America cut RBC Bearings from a "buy" rating to a "neutral" rating and lifted their price target for the company from $330.00 to $335.00 in a report on Thursday, November 21st. William Blair reissued an "outperform" rating on shares of RBC Bearings in a report on Tuesday, November 26th. Finally, Truist Financial boosted their target price on shares of RBC Bearings from $351.00 to $410.00 and gave the stock a "buy" rating in a research note on Monday. Four analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat, RBC Bearings has a consensus rating of "Moderate Buy" and an average price target of $348.50.

Read Our Latest Stock Analysis on RBC

RBC Bearings Price Performance

Shares of RBC stock traded down $4.72 during mid-day trading on Tuesday, reaching $364.78. The company's stock had a trading volume of 141,302 shares, compared to its average volume of 163,033. The firm's 50-day moving average is $318.64 and its two-hundred day moving average is $302.83. The company has a market cap of $11.46 billion, a P/E ratio of 50.11, a PEG ratio of 4.81 and a beta of 1.58. RBC Bearings has a 1-year low of $240.36 and a 1-year high of $372.51. The company has a debt-to-equity ratio of 0.34, a quick ratio of 1.18 and a current ratio of 3.43.

Insider Buying and Selling

In other RBC Bearings news, Director Michael H. Ambrose sold 400 shares of RBC Bearings stock in a transaction dated Wednesday, February 5th. The stock was sold at an average price of $362.89, for a total transaction of $145,156.00. Following the transaction, the director now directly owns 6,728 shares in the company, valued at approximately $2,441,523.92. The trade was a 5.61 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. 2.60% of the stock is owned by insiders.

Hedge Funds Weigh In On RBC Bearings

Institutional investors have recently modified their holdings of the business. UMB Bank n.a. raised its holdings in RBC Bearings by 416.7% during the 3rd quarter. UMB Bank n.a. now owns 93 shares of the industrial products company's stock worth $28,000 after buying an additional 75 shares during the period. R Squared Ltd bought a new stake in shares of RBC Bearings during the fourth quarter worth $30,000. Golden State Wealth Management LLC acquired a new stake in shares of RBC Bearings during the fourth quarter worth $38,000. Harbor Investment Advisory LLC bought a new stake in RBC Bearings in the 4th quarter valued at $82,000. Finally, Blue Trust Inc. boosted its stake in RBC Bearings by 541.9% in the 3rd quarter. Blue Trust Inc. now owns 276 shares of the industrial products company's stock worth $83,000 after purchasing an additional 233 shares during the period.

RBC Bearings Company Profile

(

Get Free Report)

RBC Bearings Incorporated manufactures and markets engineered precision bearings, components, and systems in the United States and internationally. It operates through two segments, Aerospace/Defense and Industrial. The company produces plain bearings with self-lubricating or metal-to-metal designs, including rod end bearings, spherical plain bearings, and journal bearings; roller bearings, such as tapered roller bearings, needle roller bearings, and needle bearing track rollers and cam followers, which are anti-friction products that are used in industrial applications and military aircraft platforms; and ball bearings include high precision aerospace, airframe control, thin section, and industrial ball bearings that utilize high precision ball elements to reduce friction in high-speed applications.

Read More

Before you consider RBC Bearings, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RBC Bearings wasn't on the list.

While RBC Bearings currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, Starlink, or X.AI? Enter your email address to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.