RBF Capital LLC raised its position in shares of Oportun Financial Co. (NASDAQ:OPRT - Free Report) by 82.9% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 978,079 shares of the company's stock after acquiring an additional 443,177 shares during the quarter. RBF Capital LLC owned about 2.72% of Oportun Financial worth $2,748,000 as of its most recent SEC filing.

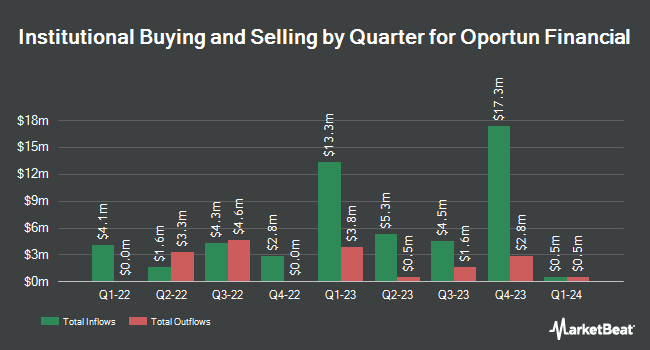

Other institutional investors have also bought and sold shares of the company. Public Employees Retirement System of Ohio boosted its position in Oportun Financial by 30.4% during the first quarter. Public Employees Retirement System of Ohio now owns 15,103 shares of the company's stock valued at $37,000 after acquiring an additional 3,521 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. bought a new stake in Oportun Financial during the third quarter valued at $52,000. Flaharty Asset Management LLC boosted its position in shares of Oportun Financial by 75.0% during the 2nd quarter. Flaharty Asset Management LLC now owns 35,000 shares of the company's stock worth $102,000 after purchasing an additional 15,000 shares in the last quarter. SkyView Investment Advisors LLC boosted its position in shares of Oportun Financial by 28.6% during the 2nd quarter. SkyView Investment Advisors LLC now owns 67,500 shares of the company's stock worth $196,000 after purchasing an additional 15,000 shares in the last quarter. Finally, Empowered Funds LLC boosted its position in shares of Oportun Financial by 5.4% during the 3rd quarter. Empowered Funds LLC now owns 110,620 shares of the company's stock worth $311,000 after purchasing an additional 5,628 shares in the last quarter. Institutional investors own 82.70% of the company's stock.

Oportun Financial Trading Down 1.2 %

Shares of OPRT traded down $0.05 on Thursday, reaching $3.96. The company's stock had a trading volume of 105,939 shares, compared to its average volume of 230,377. Oportun Financial Co. has a twelve month low of $2.05 and a twelve month high of $4.60. The stock has a market capitalization of $142.44 million, a PE ratio of -1.22 and a beta of 1.17. The firm has a fifty day moving average of $2.96 and a 200-day moving average of $2.97.

Insider Buying and Selling at Oportun Financial

In related news, CEO Raul Vazquez purchased 8,844 shares of the firm's stock in a transaction dated Wednesday, November 27th. The stock was bought at an average price of $3.86 per share, for a total transaction of $34,137.84. Following the purchase, the chief executive officer now directly owns 1,257,328 shares in the company, valued at approximately $4,853,286.08. This trade represents a 0.71 % increase in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Company insiders own 9.30% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on OPRT shares. JMP Securities reissued a "market perform" rating on shares of Oportun Financial in a research report on Monday, August 12th. Singular Research raised shares of Oportun Financial to a "strong-buy" rating in a research report on Friday, September 20th. Three equities research analysts have rated the stock with a hold rating, one has given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $5.50.

View Our Latest Report on OPRT

Oportun Financial Profile

(

Free Report)

Oportun Financial Corporation provides financial services. The company offers personal loans and credit cards. It serves customers through online and over the phone, as well as through retail and Lending as a Service partner locations. The company was founded in 2005 and is headquartered in San Carlos, California.

Recommended Stories

Before you consider Oportun Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Oportun Financial wasn't on the list.

While Oportun Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.