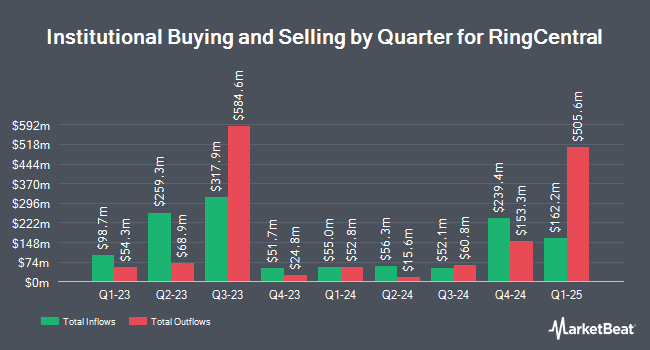

RBF Capital LLC acquired a new stake in shares of RingCentral, Inc. (NYSE:RNG - Free Report) in the third quarter, according to the company in its most recent filing with the SEC. The firm acquired 15,000 shares of the software maker's stock, valued at approximately $474,000.

Other institutional investors and hedge funds have also modified their holdings of the company. Point72 DIFC Ltd purchased a new position in RingCentral during the second quarter worth approximately $39,000. Venturi Wealth Management LLC lifted its position in shares of RingCentral by 150.4% during the 3rd quarter. Venturi Wealth Management LLC now owns 1,863 shares of the software maker's stock valued at $59,000 after buying an additional 1,119 shares in the last quarter. KBC Group NV grew its stake in RingCentral by 38.9% in the 3rd quarter. KBC Group NV now owns 2,659 shares of the software maker's stock valued at $84,000 after acquiring an additional 744 shares during the period. Central Pacific Bank Trust Division purchased a new stake in RingCentral in the 3rd quarter worth $121,000. Finally, CWM LLC lifted its holdings in RingCentral by 595.9% during the third quarter. CWM LLC now owns 4,746 shares of the software maker's stock valued at $150,000 after purchasing an additional 4,064 shares in the last quarter. Institutional investors and hedge funds own 98.61% of the company's stock.

Insider Activity at RingCentral

In other RingCentral news, CFO Vaibhav Agarwal sold 2,178 shares of the business's stock in a transaction that occurred on Monday, November 18th. The shares were sold at an average price of $35.27, for a total transaction of $76,818.06. Following the completion of the transaction, the chief financial officer now owns 135,560 shares in the company, valued at $4,781,201.20. The trade was a 1.58 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, SVP John H. Marlow sold 23,284 shares of the firm's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $34.96, for a total transaction of $814,008.64. Following the completion of the sale, the senior vice president now owns 357,818 shares in the company, valued at $12,509,317.28. The trade was a 6.11 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 104,082 shares of company stock worth $3,632,417. Company insiders own 6.76% of the company's stock.

RingCentral Stock Performance

NYSE RNG traded down $0.85 during trading on Thursday, hitting $38.94. The stock had a trading volume of 519,069 shares, compared to its average volume of 1,227,369. RingCentral, Inc. has a twelve month low of $26.98 and a twelve month high of $40.98. The firm has a 50 day moving average price of $34.74 and a 200 day moving average price of $32.76.

RingCentral (NYSE:RNG - Get Free Report) last released its earnings results on Thursday, November 7th. The software maker reported $0.24 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.14 by $0.10. The company had revenue of $608.77 million for the quarter, compared to analyst estimates of $601.91 million. RingCentral had a negative net margin of 4.17% and a negative return on equity of 2.55%. As a group, analysts anticipate that RingCentral, Inc. will post 0.84 EPS for the current year.

Analysts Set New Price Targets

RNG has been the subject of several research analyst reports. StockNews.com upgraded shares of RingCentral from a "buy" rating to a "strong-buy" rating in a research report on Monday, November 11th. Wedbush raised their target price on RingCentral from $36.00 to $41.00 and gave the company a "neutral" rating in a research report on Friday, November 8th. Raymond James dropped their price target on RingCentral from $52.00 to $50.00 and set a "strong-buy" rating for the company in a research report on Friday, November 8th. Piper Sandler raised their price objective on RingCentral from $31.00 to $38.00 and gave the company a "neutral" rating in a report on Friday, November 8th. Finally, Rosenblatt Securities reaffirmed a "buy" rating and set a $45.00 target price on shares of RingCentral in a report on Friday, November 8th. Eight investment analysts have rated the stock with a hold rating, six have given a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $40.73.

Check Out Our Latest Stock Report on RingCentral

RingCentral Company Profile

(

Free Report)

RingCentral, Inc, together with its subsidiaries, provides cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions worldwide. The company's products include RingCentral Message Video Phone that provides a unified experience for communication and collaboration across multiple modes, including HD voice, video, SMS, messaging and collaboration, conferencing, online meetings, and fax; RingCentral Contact Center, a collaborative contact center solution that delivers AI-powered omnichannel and workforce engagement solutions with integrated RingCentral MVP; and RingCX, an AI-powered contact center that a native delivers omnichannel experience.

Featured Articles

Before you consider RingCentral, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RingCentral wasn't on the list.

While RingCentral currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.