RBF Capital LLC acquired a new stake in shares of Chart Industries, Inc. (NYSE:GTLS - Free Report) in the third quarter, according to the company in its most recent filing with the SEC. The firm acquired 33,000 shares of the industrial products company's stock, valued at approximately $4,097,000. RBF Capital LLC owned approximately 0.08% of Chart Industries at the end of the most recent reporting period.

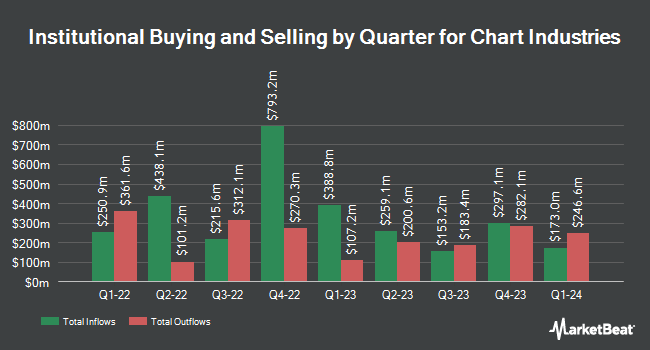

Other institutional investors and hedge funds also recently added to or reduced their stakes in the company. Ashton Thomas Securities LLC bought a new stake in Chart Industries during the 3rd quarter valued at about $34,000. Byrne Asset Management LLC bought a new stake in shares of Chart Industries in the 2nd quarter valued at about $40,000. UMB Bank n.a. raised its holdings in shares of Chart Industries by 418.0% in the 3rd quarter. UMB Bank n.a. now owns 316 shares of the industrial products company's stock valued at $39,000 after purchasing an additional 255 shares in the last quarter. Ecofi Investissements SA bought a new stake in shares of Chart Industries in the 2nd quarter valued at about $50,000. Finally, Central Bank & Trust Co. bought a new stake in shares of Chart Industries in the 2nd quarter valued at about $86,000.

Chart Industries Price Performance

GTLS traded down $0.20 during midday trading on Thursday, hitting $190.79. 184,406 shares of the company traded hands, compared to its average volume of 656,346. The company has a current ratio of 1.27, a quick ratio of 1.00 and a debt-to-equity ratio of 1.16. The company has a market capitalization of $8.17 billion, a price-to-earnings ratio of 55.37, a PEG ratio of 0.99 and a beta of 1.86. Chart Industries, Inc. has a 52-week low of $101.60 and a 52-week high of $196.91. The business has a 50 day simple moving average of $147.95 and a two-hundred day simple moving average of $140.75.

Chart Industries (NYSE:GTLS - Get Free Report) last posted its quarterly earnings data on Friday, November 1st. The industrial products company reported $2.18 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.56 by ($0.38). The company had revenue of $1.06 billion for the quarter, compared to analysts' expectations of $1.10 billion. Chart Industries had a net margin of 4.30% and a return on equity of 13.25%. The business's revenue for the quarter was up 18.3% on a year-over-year basis. During the same period in the previous year, the business earned $1.28 earnings per share. On average, equities analysts forecast that Chart Industries, Inc. will post 9.03 earnings per share for the current fiscal year.

Insider Transactions at Chart Industries

In other Chart Industries news, Director Linda S. Harty purchased 5,000 shares of the firm's stock in a transaction dated Monday, September 16th. The shares were purchased at an average cost of $48.05 per share, with a total value of $240,250.00. Following the completion of the purchase, the director now owns 5,000 shares in the company, valued at approximately $240,250. This represents a ∞ increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available through this link. Also, Director Paul E. Mahoney purchased 500 shares of the firm's stock in a transaction dated Wednesday, September 11th. The stock was acquired at an average cost of $106.55 per share, for a total transaction of $53,275.00. Following the completion of the purchase, the director now owns 2,107 shares of the company's stock, valued at approximately $224,500.85. This represents a 31.11 % increase in their position. The disclosure for this purchase can be found here. Over the last three months, insiders have acquired 6,712 shares of company stock valued at $431,982. Corporate insiders own 0.95% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have recently commented on the stock. Wells Fargo & Company reduced their price target on shares of Chart Industries from $151.00 to $146.00 and set an "overweight" rating for the company in a report on Thursday, October 3rd. Stifel Nicolaus boosted their price target on shares of Chart Industries from $198.00 to $200.00 and gave the company a "buy" rating in a report on Monday, November 4th. The Goldman Sachs Group reduced their price target on shares of Chart Industries from $168.00 to $144.00 and set a "neutral" rating for the company in a report on Thursday, August 29th. Barclays reduced their price objective on shares of Chart Industries from $146.00 to $145.00 and set an "equal weight" rating for the company in a research note on Monday, November 4th. Finally, Bank of America reduced their price objective on shares of Chart Industries from $185.00 to $165.00 and set a "buy" rating for the company in a research note on Monday, October 14th. Three investment analysts have rated the stock with a hold rating, seven have given a buy rating and two have assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $178.82.

Check Out Our Latest Research Report on Chart Industries

Chart Industries Company Profile

(

Free Report)

Chart Industries, Inc engages in the designing, engineering, and manufacturing of process technologies and equipment for the gas and liquid molecules in the United States and internationally. The company operates in four segments: Cryo Tank Solutions, Heat Transfer Systems, Specialty Products, and Repair, Service & Leasing.

Further Reading

Before you consider Chart Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chart Industries wasn't on the list.

While Chart Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.