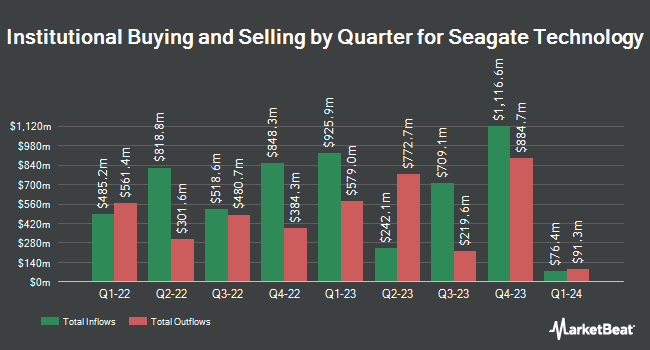

Readystate Asset Management LP boosted its holdings in shares of Seagate Technology Holdings plc (NASDAQ:STX - Free Report) by 219.3% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 45,470 shares of the data storage provider's stock after purchasing an additional 31,228 shares during the period. Readystate Asset Management LP's holdings in Seagate Technology were worth $4,980,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Sanders Capital LLC lifted its stake in Seagate Technology by 0.9% during the third quarter. Sanders Capital LLC now owns 16,367,591 shares of the data storage provider's stock worth $1,792,742,000 after purchasing an additional 150,115 shares during the period. Duquesne Family Office LLC lifted its stake in Seagate Technology by 22.0% during the second quarter. Duquesne Family Office LLC now owns 1,755,278 shares of the data storage provider's stock worth $181,268,000 after purchasing an additional 316,295 shares during the period. Charles Schwab Investment Management Inc. raised its stake in shares of Seagate Technology by 5.8% in the third quarter. Charles Schwab Investment Management Inc. now owns 1,327,920 shares of the data storage provider's stock valued at $145,447,000 after acquiring an additional 73,267 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in shares of Seagate Technology by 341.7% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,308,958 shares of the data storage provider's stock valued at $143,370,000 after acquiring an additional 1,012,638 shares during the last quarter. Finally, Point72 Asset Management L.P. bought a new position in shares of Seagate Technology in the third quarter valued at approximately $133,031,000. Institutional investors own 92.87% of the company's stock.

Insider Activity

In other Seagate Technology news, Director Jay L. Geldmacher sold 4,100 shares of the business's stock in a transaction dated Thursday, October 24th. The shares were sold at an average price of $103.30, for a total transaction of $423,530.00. Following the sale, the director now directly owns 2,852 shares of the company's stock, valued at $294,611.60. The trade was a 58.98 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available through this link. Also, EVP Ban Seng Teh sold 4,872 shares of the business's stock in a transaction dated Thursday, September 26th. The stock was sold at an average price of $110.00, for a total transaction of $535,920.00. Following the sale, the executive vice president now directly owns 9,969 shares in the company, valued at $1,096,590. This trade represents a 32.83 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 221,820 shares of company stock valued at $23,953,746 in the last quarter. Company insiders own 0.81% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts have recently issued reports on the stock. Northland Securities lifted their target price on shares of Seagate Technology from $142.00 to $144.00 and gave the company an "outperform" rating in a research note on Wednesday, October 23rd. Citigroup lifted their target price on shares of Seagate Technology from $125.00 to $130.00 and gave the company a "buy" rating in a research note on Wednesday, October 23rd. StockNews.com upgraded shares of Seagate Technology from a "hold" rating to a "buy" rating in a research note on Thursday, October 17th. Benchmark reissued a "hold" rating on shares of Seagate Technology in a report on Wednesday, October 23rd. Finally, Cantor Fitzgerald reissued a "neutral" rating and issued a $125.00 price target on shares of Seagate Technology in a report on Wednesday, October 23rd. Two analysts have rated the stock with a sell rating, six have given a hold rating and twelve have given a buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average price target of $118.83.

Read Our Latest Stock Report on Seagate Technology

Seagate Technology Stock Performance

STX traded down $1.17 during trading on Thursday, reaching $97.63. 4,572,320 shares of the company's stock were exchanged, compared to its average volume of 1,983,352. The company's fifty day moving average price is $104.10 and its 200-day moving average price is $102.04. Seagate Technology Holdings plc has a fifty-two week low of $76.87 and a fifty-two week high of $115.32. The firm has a market capitalization of $20.65 billion, a PE ratio of 25.49 and a beta of 1.03.

Seagate Technology (NASDAQ:STX - Get Free Report) last announced its quarterly earnings results on Tuesday, October 22nd. The data storage provider reported $1.58 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.30 by $0.28. Seagate Technology had a net margin of 11.34% and a negative return on equity of 32.19%. The company had revenue of $2.17 billion during the quarter, compared to analyst estimates of $2.13 billion. During the same quarter in the previous year, the business earned ($0.34) EPS. The firm's revenue was up 49.1% on a year-over-year basis. Research analysts forecast that Seagate Technology Holdings plc will post 7.18 earnings per share for the current fiscal year.

Seagate Technology Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Monday, January 6th. Stockholders of record on Sunday, December 15th will be issued a $0.72 dividend. This is a positive change from Seagate Technology's previous quarterly dividend of $0.70. The ex-dividend date of this dividend is Friday, December 13th. This represents a $2.88 annualized dividend and a dividend yield of 2.95%. Seagate Technology's payout ratio is 73.11%.

Seagate Technology Profile

(

Free Report)

Seagate Technology Holdings plc provides data storage technology and solutions in Singapore, the United States, the Netherlands, and internationally. It provides mass capacity storage products, including enterprise nearline hard disk drives (HDDs), enterprise nearline solid state drives (SSDs), enterprise nearline systems, video and image HDDs, and network-attached storage drives.

Featured Articles

Before you consider Seagate Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seagate Technology wasn't on the list.

While Seagate Technology currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report