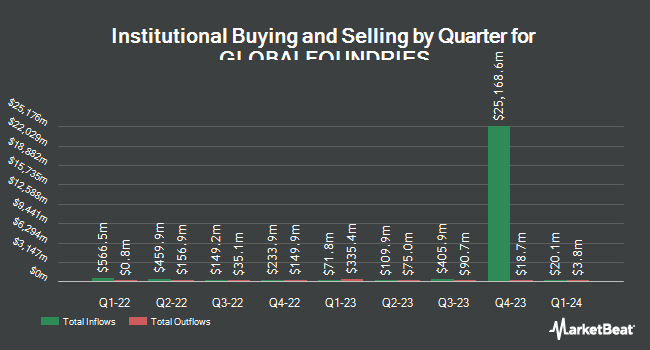

Readystate Asset Management LP purchased a new position in shares of GlobalFoundries Inc. (NASDAQ:GFS - Free Report) during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The institutional investor purchased 11,754 shares of the company's stock, valued at approximately $473,000.

Other institutional investors and hedge funds have also made changes to their positions in the company. FMR LLC increased its position in GlobalFoundries by 2.4% in the 3rd quarter. FMR LLC now owns 49,375,403 shares of the company's stock valued at $1,987,360,000 after acquiring an additional 1,160,403 shares during the period. Marshall Wace LLP increased its position in GlobalFoundries by 108.6% in the 2nd quarter. Marshall Wace LLP now owns 2,496,871 shares of the company's stock valued at $126,242,000 after acquiring an additional 1,299,687 shares during the period. Dimensional Fund Advisors LP increased its position in GlobalFoundries by 13.5% in the 2nd quarter. Dimensional Fund Advisors LP now owns 653,918 shares of the company's stock valued at $33,063,000 after acquiring an additional 77,581 shares during the period. Citigroup Inc. increased its position in GlobalFoundries by 16.0% in the 3rd quarter. Citigroup Inc. now owns 628,259 shares of the company's stock valued at $25,287,000 after acquiring an additional 86,740 shares during the period. Finally, Renaissance Technologies LLC increased its position in GlobalFoundries by 267.7% in the 2nd quarter. Renaissance Technologies LLC now owns 354,049 shares of the company's stock valued at $17,901,000 after acquiring an additional 257,749 shares during the period.

GlobalFoundries Stock Performance

GFS stock traded up $0.60 during trading on Friday, reaching $44.88. 2,122,312 shares of the stock were exchanged, compared to its average volume of 1,631,561. The company has a current ratio of 2.42, a quick ratio of 1.76 and a debt-to-equity ratio of 0.19. The stock has a 50 day simple moving average of $41.34 and a 200-day simple moving average of $45.47. The company has a market capitalization of $24.76 billion, a P/E ratio of 33.49, a price-to-earnings-growth ratio of 10.90 and a beta of 1.59. GlobalFoundries Inc. has a twelve month low of $35.85 and a twelve month high of $62.61.

GlobalFoundries (NASDAQ:GFS - Get Free Report) last released its quarterly earnings data on Tuesday, November 5th. The company reported $0.41 earnings per share for the quarter, beating analysts' consensus estimates of $0.33 by $0.08. The company had revenue of $1.74 billion for the quarter, compared to the consensus estimate of $1.73 billion. GlobalFoundries had a return on equity of 6.87% and a net margin of 10.95%. The company's quarterly revenue was down 6.1% on a year-over-year basis. During the same period in the previous year, the business earned $0.47 earnings per share. As a group, sell-side analysts anticipate that GlobalFoundries Inc. will post 1.22 earnings per share for the current year.

Wall Street Analysts Forecast Growth

GFS has been the subject of a number of research reports. Evercore ISI decreased their price target on GlobalFoundries from $71.00 to $55.00 and set an "outperform" rating for the company in a research note on Wednesday, November 6th. Morgan Stanley lowered GlobalFoundries from an "overweight" rating to an "equal weight" rating and reduced their price objective for the stock from $53.00 to $43.00 in a research note on Monday, October 28th. UBS Group assumed coverage on GlobalFoundries in a research note on Wednesday, November 20th. They set a "neutral" rating and a $47.00 price objective for the company. Cantor Fitzgerald reissued a "neutral" rating and set a $40.00 price objective on shares of GlobalFoundries in a research note on Wednesday, November 6th. Finally, Robert W. Baird reduced their price objective on GlobalFoundries from $63.00 to $50.00 and set an "outperform" rating for the company in a research note on Wednesday, November 6th. Nine investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company has a consensus rating of "Hold" and an average price target of $50.21.

View Our Latest Stock Report on GlobalFoundries

About GlobalFoundries

(

Free Report)

GlobalFoundries Inc, a semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide. It manufactures various semiconductor devices, including microprocessors, mobile application processors, baseband processors, network processors, radio frequency modems, microcontrollers, and power management units.

Read More

Before you consider GlobalFoundries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GlobalFoundries wasn't on the list.

While GlobalFoundries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.