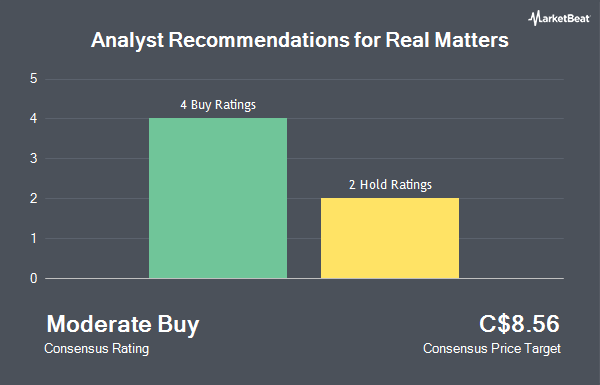

Real Matters Inc. (TSE:REAL - Get Free Report) has received an average recommendation of "Moderate Buy" from the six analysts that are currently covering the firm, MarketBeat.com reports. Two investment analysts have rated the stock with a hold recommendation and four have given a buy recommendation to the company. The average 12 month price target among analysts that have updated their coverage on the stock in the last year is C$8.64.

Separately, Cormark lowered their target price on Real Matters from C$8.75 to C$7.50 in a research note on Thursday, January 30th.

Get Our Latest Analysis on Real Matters

Insider Activity at Real Matters

In other Real Matters news, Senior Officer Ryan Jacob Smith sold 10,752 shares of the stock in a transaction on Monday, February 3rd. The shares were sold at an average price of C$5.76, for a total value of C$61,931.52. Also, Director Kay Brekken acquired 7,870 shares of the firm's stock in a transaction dated Monday, February 3rd. The stock was purchased at an average cost of C$6.10 per share, with a total value of C$48,004.64. Insiders own 5.17% of the company's stock.

Real Matters Trading Down 1.1 %

Shares of Real Matters stock traded down C$0.06 on Tuesday, hitting C$5.64. 140,927 shares of the company's stock traded hands, compared to its average volume of 67,878. The company has a debt-to-equity ratio of 2.27, a current ratio of 4.68 and a quick ratio of 3.75. Real Matters has a one year low of C$4.95 and a one year high of C$9.46. The firm's 50-day moving average price is C$5.97 and its two-hundred day moving average price is C$6.95. The stock has a market capitalization of C$290.17 million, a PE ratio of 56.49, a price-to-earnings-growth ratio of -59.18 and a beta of 0.86.

About Real Matters

(

Get Free ReportReal Matters Inc operates as a technology and network management company in Canada and the United States. It operates through three segments: U.S. Appraisal, U.S. Title, and Canada. It offers residential mortgage appraisals for purchase, refinance, and home equity and default transactions to the mortgage lending industry, as well as title services for refinance, purchase, home equity, short sale, and real estate-owned transactions to financial institutions under the Solidifi brand; and insurance inspection services to property and casualty insurers under the iv3 brand.

Further Reading

Before you consider Real Matters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Real Matters wasn't on the list.

While Real Matters currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.