Wells Fargo & Company upgraded shares of RealReal (NASDAQ:REAL - Free Report) from an equal weight rating to an overweight rating in a research report released on Monday morning, MarketBeat Ratings reports. The brokerage currently has $15.00 target price on the stock, up from their prior target price of $4.00.

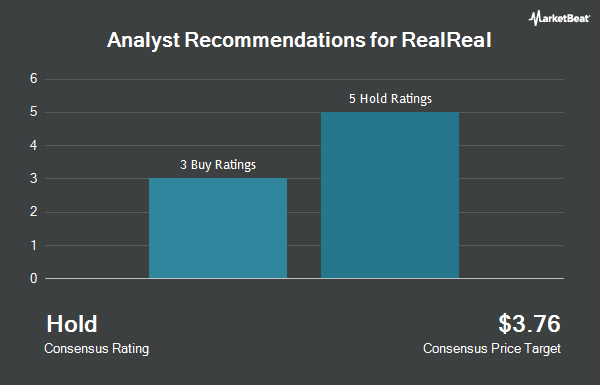

REAL has been the subject of several other research reports. Northland Capmk upgraded RealReal to a "strong-buy" rating in a research report on Monday, September 16th. UBS Group lifted their price target on RealReal from $3.00 to $3.25 and gave the company a "neutral" rating in a report on Tuesday, November 5th. Finally, Northland Securities started coverage on shares of RealReal in a research report on Monday, September 16th. They set an "outperform" rating and a $6.00 price target on the stock. Two investment analysts have rated the stock with a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, RealReal currently has a consensus rating of "Moderate Buy" and an average price target of $6.29.

Get Our Latest Stock Analysis on RealReal

RealReal Price Performance

Shares of NASDAQ:REAL traded up $2.52 during trading on Monday, reaching $8.96. The stock had a trading volume of 13,664,056 shares, compared to its average volume of 2,654,588. The stock has a market capitalization of $982.83 million, a PE ratio of -9.59 and a beta of 3.09. RealReal has a 52 week low of $1.52 and a 52 week high of $9.29. The business's 50-day moving average price is $3.92 and its 200 day moving average price is $3.44.

Insider Activity

In other news, CAO Steve Ming Lo sold 96,666 shares of the firm's stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $6.10, for a total value of $589,662.60. Following the transaction, the chief accounting officer now owns 391,525 shares of the company's stock, valued at approximately $2,388,302.50. This trade represents a 19.80 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Insiders own 9.78% of the company's stock.

Institutional Investors Weigh In On RealReal

A number of institutional investors and hedge funds have recently modified their holdings of the business. Drive Wealth Management LLC bought a new position in RealReal in the second quarter valued at approximately $32,000. Calamos Advisors LLC bought a new position in shares of RealReal in the 2nd quarter worth $34,000. Evoke Wealth LLC acquired a new stake in shares of RealReal during the second quarter worth $36,000. Principal Financial Group Inc. acquired a new stake in shares of RealReal during the second quarter worth $39,000. Finally, Park Edge Advisors LLC bought a new stake in RealReal in the third quarter valued at about $41,000. 64.73% of the stock is owned by institutional investors.

RealReal Company Profile

(

Get Free Report)

The RealReal, Inc operates an online marketplace for resale luxury goods in the United State. The company offers various product categories, including women's fashion, men's fashion, jewelry, and watches. It primarily sells products through online marketplace and retail stores. The company was incorporated in 2011 and is headquartered in San Francisco, California.

Further Reading

Before you consider RealReal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RealReal wasn't on the list.

While RealReal currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.