Truist Financial began coverage on shares of Reddit (NYSE:RDDT - Free Report) in a report issued on Monday morning, MarketBeat Ratings reports. The firm issued a buy rating and a $150.00 price objective on the stock.

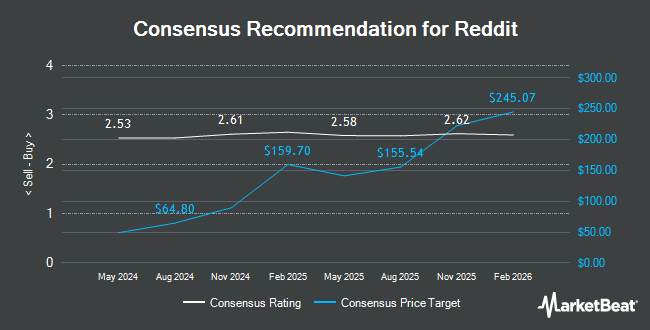

Other research analysts have also recently issued reports about the stock. Citigroup restated an "outperform" rating on shares of Reddit in a report on Friday, March 28th. The Goldman Sachs Group boosted their target price on Reddit from $105.00 to $176.00 and gave the stock a "neutral" rating in a research note on Tuesday, January 14th. Morgan Stanley increased their price target on Reddit from $200.00 to $210.00 and gave the company an "overweight" rating in a research report on Thursday, February 13th. Needham & Company LLC reissued a "buy" rating and issued a $220.00 price objective on shares of Reddit in a research report on Friday, March 21st. Finally, B. Riley raised their target price on Reddit from $112.00 to $187.00 and gave the company a "buy" rating in a research report on Tuesday, January 14th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating, thirteen have issued a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $151.73.

Read Our Latest Research Report on RDDT

Reddit Stock Performance

Shares of Reddit stock traded down $2.41 on Monday, hitting $99.60. The company had a trading volume of 2,453,170 shares, compared to its average volume of 5,475,865. Reddit has a 1 year low of $37.35 and a 1 year high of $230.41. The stock has a 50 day moving average of $146.17 and a 200-day moving average of $139.62. The stock has a market capitalization of $18.02 billion and a price-to-earnings ratio of -12.81.

Reddit (NYSE:RDDT - Get Free Report) last released its quarterly earnings results on Wednesday, February 12th. The company reported $0.36 EPS for the quarter, beating analysts' consensus estimates of $0.24 by $0.12. Reddit had a negative return on equity of 24.71% and a negative net margin of 37.25%. Equities analysts anticipate that Reddit will post 1.12 earnings per share for the current year.

Insider Buying and Selling

In other news, CEO Steve Ladd Huffman sold 14,000 shares of the business's stock in a transaction on Monday, March 31st. The shares were sold at an average price of $103.28, for a total transaction of $1,445,920.00. Following the completion of the transaction, the chief executive officer now directly owns 577,013 shares in the company, valued at $59,593,902.64. The trade was a 2.37 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director David C. Habiger acquired 774 shares of the stock in a transaction that occurred on Wednesday, March 12th. The stock was acquired at an average price of $130.36 per share, for a total transaction of $100,898.64. Following the transaction, the director now directly owns 30,808 shares of the company's stock, valued at $4,016,130.88. This represents a 2.58 % increase in their position. The disclosure for this purchase can be found here. In the last quarter, insiders have sold 603,794 shares of company stock valued at $89,386,704.

Hedge Funds Weigh In On Reddit

Institutional investors have recently added to or reduced their stakes in the business. Jennison Associates LLC purchased a new position in shares of Reddit during the fourth quarter worth about $494,861,000. Renaissance Capital LLC lifted its position in Reddit by 14.2% during the fourth quarter. Renaissance Capital LLC now owns 31,236 shares of the company's stock valued at $5,105,000 after purchasing an additional 3,892 shares during the last quarter. Charles Schwab Investment Management Inc. grew its stake in Reddit by 27.6% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 642,456 shares of the company's stock worth $105,003,000 after buying an additional 139,135 shares in the last quarter. Assetmark Inc. increased its holdings in shares of Reddit by 1,537,566.7% in the 4th quarter. Assetmark Inc. now owns 46,130 shares of the company's stock worth $7,539,000 after buying an additional 46,127 shares during the last quarter. Finally, Wellington Management Group LLP raised its position in shares of Reddit by 3,640.5% during the 3rd quarter. Wellington Management Group LLP now owns 255,325 shares of the company's stock valued at $16,831,000 after buying an additional 248,499 shares in the last quarter.

Reddit Company Profile

(

Get Free Report)

Reddit, Inc operates a website that organizes digital communities. It organizes communities based on specific interests that enable users to engage in conversations by sharing experiences, submitting links, uploading images and videos, and replying to one another. The company was founded in 2005 and is headquartered in San Francisco, California.

Featured Stories

Before you consider Reddit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reddit wasn't on the list.

While Reddit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.