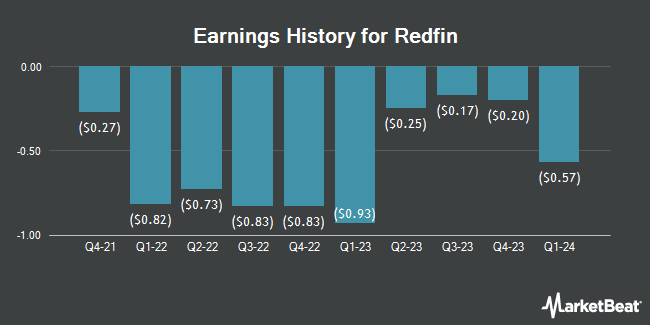

Redfin (NASDAQ:RDFN - Get Free Report) posted its earnings results on Thursday. The company reported ($0.29) EPS for the quarter, missing the consensus estimate of ($0.23) by ($0.06), Zacks reports. The business had revenue of $244.28 million for the quarter, compared to analysts' expectations of $242.51 million. Redfin updated its Q1 2025 guidance to EPS.

Redfin Stock Performance

RDFN stock traded down $0.58 during midday trading on Monday, reaching $6.09. 8,904,836 shares of the company's stock traded hands, compared to its average volume of 5,476,521. The company has a 50-day moving average price of $8.02 and a two-hundred day moving average price of $9.49. Redfin has a 52 week low of $5.10 and a 52 week high of $15.29. The firm has a market capitalization of $755.04 million, a PE ratio of -4.76 and a beta of 2.66.

Insider Buying and Selling at Redfin

In other news, insider Christian John Taubman sold 16,333 shares of the business's stock in a transaction on Monday, December 23rd. The shares were sold at an average price of $8.44, for a total transaction of $137,850.52. Following the completion of the transaction, the insider now directly owns 73,466 shares in the company, valued at $620,053.04. The trade was a 18.19 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Insiders own 4.40% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have commented on RDFN. The Goldman Sachs Group cut shares of Redfin from a "neutral" rating to a "sell" rating and lifted their target price for the stock from $6.00 to $6.50 in a research report on Monday, November 18th. Citigroup lowered their price target on shares of Redfin from $10.50 to $9.00 and set a "neutral" rating on the stock in a report on Friday, January 3rd. Wedbush lifted their price target on shares of Redfin from $8.00 to $10.00 and gave the stock a "neutral" rating in a report on Friday, November 8th. JPMorgan Chase & Co. lowered their price target on shares of Redfin from $8.00 to $7.00 and set a "neutral" rating on the stock in a report on Monday. Finally, Susquehanna lowered their price target on shares of Redfin from $10.00 to $7.00 and set a "neutral" rating on the stock in a report on Monday. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating and two have issued a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Hold" and an average target price of $9.14.

View Our Latest Research Report on Redfin

Redfin Company Profile

(

Get Free Report)

Redfin Corporation operates as a residential real estate brokerage company in the United States and Canada. The company operates an online real estate marketplace and provides real estate services, including assisting individuals in the purchase or sell of home. It also provides title and settlement services; and originates and sells mortgages.

Recommended Stories

Before you consider Redfin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Redfin wasn't on the list.

While Redfin currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.