Redfin (NASDAQ:RDFN - Free Report) had its price target hoisted by JPMorgan Chase & Co. from $7.00 to $8.00 in a research note released on Tuesday,Benzinga reports. The brokerage currently has a neutral rating on the stock.

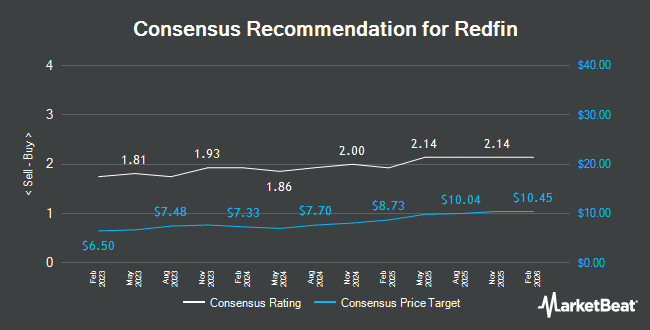

Several other analysts have also commented on the company. Wedbush raised their price objective on Redfin from $8.00 to $10.00 and gave the company a "neutral" rating in a report on Friday. Susquehanna boosted their price target on shares of Redfin from $7.00 to $10.00 and gave the stock a "neutral" rating in a report on Monday. Needham & Company LLC reaffirmed a "hold" rating on shares of Redfin in a report on Wednesday, August 7th. Jefferies Financial Group lifted their price target on Redfin from $7.50 to $11.50 and gave the stock a "hold" rating in a research note on Tuesday, October 22nd. Finally, B. Riley upped their price objective on shares of Redfin from $13.00 to $15.00 and gave the company a "buy" rating in a research note on Monday, September 30th. One equities research analyst has rated the stock with a sell rating, eight have given a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $9.23.

Check Out Our Latest Stock Report on RDFN

Redfin Stock Performance

Redfin stock traded down $0.50 during midday trading on Tuesday, hitting $9.35. 6,474,891 shares of the company were exchanged, compared to its average volume of 5,581,444. Redfin has a fifty-two week low of $5.10 and a fifty-two week high of $15.29. The firm has a market capitalization of $1.14 billion, a PE ratio of -7.48 and a beta of 2.70. The business has a fifty day simple moving average of $11.18 and a two-hundred day simple moving average of $8.57.

Redfin (NASDAQ:RDFN - Get Free Report) last released its quarterly earnings data on Thursday, November 7th. The company reported ($0.28) earnings per share for the quarter, missing analysts' consensus estimates of ($0.20) by ($0.08). The business had revenue of $278.02 million for the quarter, compared to the consensus estimate of $280.21 million. During the same period last year, the firm earned ($0.17) earnings per share. As a group, equities analysts expect that Redfin will post -1.13 earnings per share for the current year.

Insider Activity

In other news, insider Christian John Taubman sold 3,632 shares of the stock in a transaction dated Wednesday, August 21st. The stock was sold at an average price of $9.25, for a total value of $33,596.00. Following the transaction, the insider now owns 71,720 shares in the company, valued at approximately $663,410. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Insiders own 4.40% of the company's stock.

Institutional Investors Weigh In On Redfin

Hedge funds have recently added to or reduced their stakes in the company. Mather Group LLC. increased its holdings in shares of Redfin by 282.1% in the 2nd quarter. Mather Group LLC. now owns 3,821 shares of the company's stock valued at $25,000 after purchasing an additional 2,821 shares in the last quarter. Hollencrest Capital Management purchased a new stake in shares of Redfin during the 3rd quarter worth approximately $25,000. Allspring Global Investments Holdings LLC grew its holdings in shares of Redfin by 205.8% in the 1st quarter. Allspring Global Investments Holdings LLC now owns 4,608 shares of the company's stock worth $31,000 after acquiring an additional 3,101 shares during the period. Blue Trust Inc. increased its stake in Redfin by 285.7% in the 3rd quarter. Blue Trust Inc. now owns 3,302 shares of the company's stock valued at $41,000 after purchasing an additional 2,446 shares in the last quarter. Finally, Quest Partners LLC acquired a new position in Redfin during the third quarter worth $47,000. Institutional investors and hedge funds own 61.07% of the company's stock.

Redfin Company Profile

(

Get Free Report)

Redfin Corporation operates as a residential real estate brokerage company in the United States and Canada. The company operates an online real estate marketplace and provides real estate services, including assisting individuals in the purchase or sell of home. It also provides title and settlement services; and originates and sells mortgages.

Further Reading

Before you consider Redfin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Redfin wasn't on the list.

While Redfin currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.