Redmile Group LLC cut its position in shares of Ardelyx, Inc. (NASDAQ:ARDX - Free Report) by 11.7% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 1,660,763 shares of the biopharmaceutical company's stock after selling 220,738 shares during the quarter. Redmile Group LLC owned 0.70% of Ardelyx worth $11,443,000 as of its most recent SEC filing.

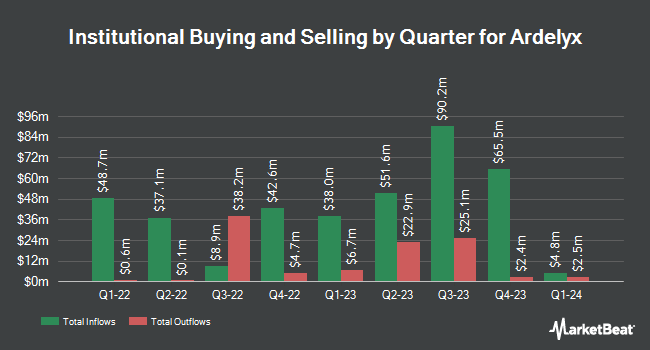

Other hedge funds and other institutional investors have also bought and sold shares of the company. World Equity Group Inc. grew its stake in shares of Ardelyx by 15.4% during the 2nd quarter. World Equity Group Inc. now owns 18,402 shares of the biopharmaceutical company's stock worth $136,000 after acquiring an additional 2,453 shares in the last quarter. Nisa Investment Advisors LLC grew its position in Ardelyx by 1,026.3% in the second quarter. Nisa Investment Advisors LLC now owns 3,548 shares of the biopharmaceutical company's stock valued at $26,000 after purchasing an additional 3,233 shares in the last quarter. Aigen Investment Management LP grew its position in Ardelyx by 29.4% in the third quarter. Aigen Investment Management LP now owns 23,510 shares of the biopharmaceutical company's stock valued at $162,000 after purchasing an additional 5,346 shares in the last quarter. Values First Advisors Inc. increased its stake in Ardelyx by 14.6% in the 3rd quarter. Values First Advisors Inc. now owns 46,282 shares of the biopharmaceutical company's stock valued at $319,000 after buying an additional 5,890 shares during the last quarter. Finally, Wealth Enhancement Advisory Services LLC lifted its position in Ardelyx by 34.3% during the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 28,365 shares of the biopharmaceutical company's stock worth $195,000 after buying an additional 7,245 shares in the last quarter. Institutional investors and hedge funds own 58.92% of the company's stock.

Ardelyx Stock Performance

Ardelyx stock traded down $0.08 during midday trading on Thursday, reaching $5.50. 2,781,620 shares of the company's stock were exchanged, compared to its average volume of 4,913,840. The company has a debt-to-equity ratio of 0.64, a quick ratio of 3.87 and a current ratio of 4.03. The stock's 50-day simple moving average is $5.74 and its 200 day simple moving average is $6.00. The firm has a market cap of $1.30 billion, a price-to-earnings ratio of -18.33 and a beta of 0.83. Ardelyx, Inc. has a 52 week low of $4.34 and a 52 week high of $10.13.

Insider Transactions at Ardelyx

In other Ardelyx news, insider Laura A. Williams sold 7,366 shares of the stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $4.79, for a total value of $35,283.14. Following the transaction, the insider now directly owns 308,745 shares of the company's stock, valued at $1,478,888.55. This represents a 2.33 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Michael Raab sold 35,000 shares of the firm's stock in a transaction that occurred on Wednesday, September 11th. The stock was sold at an average price of $5.61, for a total transaction of $196,350.00. Following the sale, the chief executive officer now owns 1,220,608 shares of the company's stock, valued at $6,847,610.88. This trade represents a 2.79 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 252,068 shares of company stock worth $1,472,641. 5.90% of the stock is owned by company insiders.

Analysts Set New Price Targets

Several equities analysts have recently weighed in on the company. Citigroup decreased their price objective on Ardelyx from $12.00 to $10.00 and set a "buy" rating for the company in a report on Monday, November 4th. HC Wainwright downgraded Ardelyx from a "buy" rating to a "neutral" rating and decreased their price target for the company from $11.00 to $5.50 in a research note on Monday, November 11th. Three investment analysts have rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $10.42.

Check Out Our Latest Research Report on Ardelyx

About Ardelyx

(

Free Report)

Ardelyx, Inc, a biopharmaceutical company, discovers, develops, and commercializes medicines to treat gastrointestinal and cardiorenal therapeutic areas in the United States and internationally. The company's lead product candidate is tenapanor for the treatment of patients with irritable bowel syndrome with constipation.

Read More

Before you consider Ardelyx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ardelyx wasn't on the list.

While Ardelyx currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.