Investment analysts at HC Wainwright started coverage on shares of Redwire (NYSE:RDW - Get Free Report) in a research note issued to investors on Tuesday, Marketbeat reports. The firm set a "buy" rating and a $18.00 price target on the stock. HC Wainwright's price target suggests a potential upside of 31.10% from the stock's previous close.

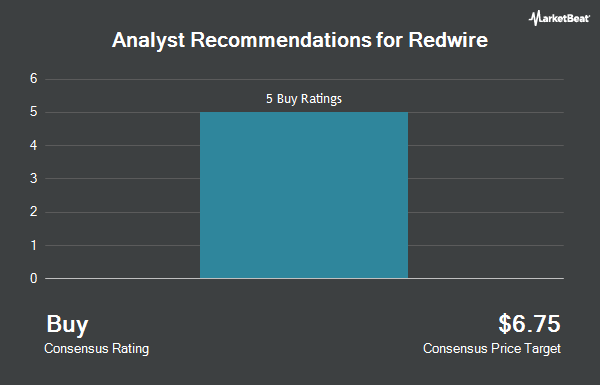

Other research analysts also recently issued reports about the stock. Roth Mkm increased their price objective on shares of Redwire from $10.00 to $13.00 and gave the company a "buy" rating in a research note on Friday, November 8th. B. Riley cut shares of Redwire from a "buy" rating to a "neutral" rating and increased their price target for the stock from $8.00 to $9.50 in a research report on Tuesday, October 29th. Alliance Global Partners lifted their price target on Redwire from $7.00 to $8.25 and gave the stock a "buy" rating in a research note on Tuesday, July 30th. Finally, Cantor Fitzgerald restated an "overweight" rating and set a $6.00 price objective on shares of Redwire in a research note on Monday, September 30th. One equities research analyst has rated the stock with a hold rating and five have issued a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $10.13.

View Our Latest Stock Report on RDW

Redwire Price Performance

RDW traded down $0.04 on Tuesday, reaching $13.73. The company's stock had a trading volume of 988,312 shares, compared to its average volume of 367,836. Redwire has a 1 year low of $2.49 and a 1 year high of $14.40. The business's 50 day moving average is $8.46 and its 200 day moving average is $6.99. The stock has a market cap of $913.59 million, a price-to-earnings ratio of -11.37 and a beta of 1.93.

Hedge Funds Weigh In On Redwire

A number of large investors have recently bought and sold shares of the business. SG Americas Securities LLC acquired a new stake in shares of Redwire during the 1st quarter valued at $59,000. Vontobel Holding Ltd. acquired a new stake in shares of Redwire during the third quarter worth $74,000. The Manufacturers Life Insurance Company purchased a new stake in shares of Redwire during the second quarter valued at $74,000. AQR Capital Management LLC acquired a new position in shares of Redwire in the 2nd quarter valued at $89,000. Finally, MetLife Investment Management LLC increased its stake in Redwire by 129.1% in the 3rd quarter. MetLife Investment Management LLC now owns 14,058 shares of the company's stock worth $97,000 after purchasing an additional 7,921 shares in the last quarter. Institutional investors own 8.10% of the company's stock.

About Redwire

(

Get Free Report)

Redwire Corporation provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally. The company provides avionics and sensors including star trackers, sun sensors, critical for navigation, and control of spacecraft; camera systems; solar array solutions for spacecraft spanning the spectrum of size, power needs, and orbital location; and strain composite booms, coilable booms, truss structures, telescope baffles, and deployable booms to position sensors or solar arrays away from the spacecraft.

Featured Stories

Before you consider Redwire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Redwire wasn't on the list.

While Redwire currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.