REE Automotive (NASDAQ:REE - Get Free Report) is anticipated to issue its quarterly earnings data before the market opens on Wednesday, March 26th. Analysts expect the company to announce earnings of ($0.79) per share for the quarter.

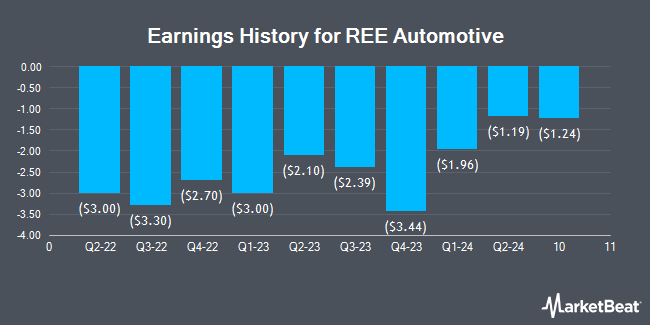

REE Automotive (NASDAQ:REE - Get Free Report) last issued its quarterly earnings data on Tuesday, December 17th. The company reported ($1.24) earnings per share for the quarter, missing analysts' consensus estimates of ($0.97) by ($0.27). On average, analysts expect REE Automotive to post $-5 EPS for the current fiscal year and $-4 EPS for the next fiscal year.

REE Automotive Stock Down 3.3 %

REE traded down $0.13 during trading on Friday, hitting $3.87. The company had a trading volume of 139,871 shares, compared to its average volume of 115,074. REE Automotive has a 1-year low of $2.91 and a 1-year high of $11.72. The company has a debt-to-equity ratio of 0.17, a current ratio of 3.21 and a quick ratio of 3.15. The company has a market cap of $53.82 million, a PE ratio of -0.42 and a beta of 2.94. The business has a 50-day moving average of $7.45 and a 200-day moving average of $7.42.

Analyst Upgrades and Downgrades

Separately, HC Wainwright reaffirmed a "buy" rating and set a $15.00 price target on shares of REE Automotive in a research report on Wednesday.

Read Our Latest Stock Report on REE Automotive

About REE Automotive

(

Get Free Report)

REE Automotive Ltd. operates as an automotive technology company in France, the United Kingdom, the United States, and internationally. The company offers REEcorner, a compact module that integrates critical vehicle drive components comprising as steering, braking, suspension, powertrain, and control between the chassis and the wheel; and REEplatform that allows for the addition of a modular and customizable top hat/cabin design based on customer specifications, without requiring modification to the platform.

Further Reading

Before you consider REE Automotive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REE Automotive wasn't on the list.

While REE Automotive currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.