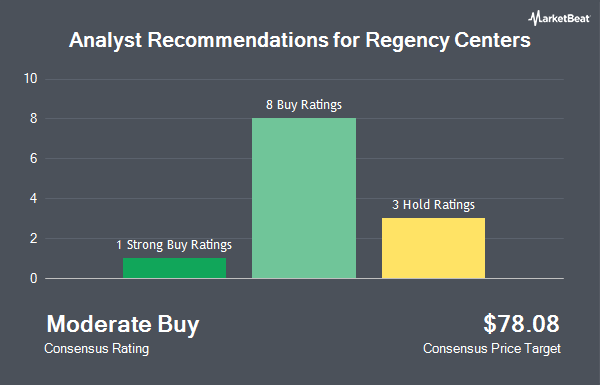

Regency Centers Co. (NASDAQ:REG - Get Free Report) has received a consensus rating of "Moderate Buy" from the twelve ratings firms that are covering the firm, Marketbeat reports. Three analysts have rated the stock with a hold rating, eight have issued a buy rating and one has issued a strong buy rating on the company. The average 1 year price objective among brokerages that have issued a report on the stock in the last year is $78.00.

A number of research analysts have weighed in on the stock. Evercore ISI dropped their target price on shares of Regency Centers from $78.00 to $77.00 and set an "in-line" rating on the stock in a research note on Tuesday, December 24th. Mizuho raised their target price on Regency Centers from $78.00 to $80.00 and gave the stock an "outperform" rating in a research report on Wednesday, January 8th. KeyCorp started coverage on shares of Regency Centers in a research note on Friday, October 25th. They issued an "overweight" rating and a $80.00 target price for the company. Robert W. Baird upped their price target on shares of Regency Centers from $71.00 to $78.00 and gave the company an "outperform" rating in a research note on Thursday, October 31st. Finally, BTIG Research raised their price objective on shares of Regency Centers from $72.00 to $79.00 and gave the stock a "buy" rating in a report on Wednesday, November 27th.

Get Our Latest Analysis on Regency Centers

Regency Centers Stock Up 1.0 %

Shares of NASDAQ:REG traded up $0.70 during trading on Friday, reaching $71.77. 797,714 shares of the stock were exchanged, compared to its average volume of 757,312. The company has a debt-to-equity ratio of 0.65, a current ratio of 0.95 and a quick ratio of 0.95. The stock has a fifty day moving average of $73.30 and a two-hundred day moving average of $71.71. Regency Centers has a 1-year low of $56.51 and a 1-year high of $76.53. The firm has a market cap of $13.03 billion, a price-to-earnings ratio of 33.69, a price-to-earnings-growth ratio of 3.68 and a beta of 1.22.

Regency Centers (NASDAQ:REG - Get Free Report) last released its quarterly earnings results on Monday, October 28th. The company reported $0.54 EPS for the quarter, missing analysts' consensus estimates of $1.04 by ($0.50). Regency Centers had a net margin of 27.78% and a return on equity of 5.85%. The company had revenue of $360.27 million during the quarter, compared to analysts' expectations of $355.17 million. During the same period in the previous year, the company posted $1.02 earnings per share. Research analysts anticipate that Regency Centers will post 4.28 earnings per share for the current fiscal year.

Regency Centers Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, January 3rd. Investors of record on Monday, December 16th were paid a $0.705 dividend. The ex-dividend date was Monday, December 16th. This represents a $2.82 annualized dividend and a dividend yield of 3.93%. This is an increase from Regency Centers's previous quarterly dividend of $0.67. Regency Centers's dividend payout ratio is presently 132.39%.

Institutional Investors Weigh In On Regency Centers

Several institutional investors and hedge funds have recently made changes to their positions in REG. Glenmede Trust Co. NA lifted its position in Regency Centers by 4.4% during the third quarter. Glenmede Trust Co. NA now owns 3,382 shares of the company's stock valued at $244,000 after purchasing an additional 141 shares during the period. Coldstream Capital Management Inc. grew its holdings in Regency Centers by 4.3% during the third quarter. Coldstream Capital Management Inc. now owns 3,950 shares of the company's stock valued at $286,000 after purchasing an additional 163 shares during the period. Greenleaf Trust increased its holdings in Regency Centers by 3.8% in the 4th quarter. Greenleaf Trust now owns 4,735 shares of the company's stock worth $350,000 after acquiring an additional 172 shares in the last quarter. Azzad Asset Management Inc. ADV raised its position in shares of Regency Centers by 4.3% during the 3rd quarter. Azzad Asset Management Inc. ADV now owns 4,543 shares of the company's stock valued at $328,000 after purchasing an additional 189 shares during the period. Finally, Tectonic Advisors LLC lifted its stake in shares of Regency Centers by 3.0% during the 3rd quarter. Tectonic Advisors LLC now owns 6,941 shares of the company's stock valued at $501,000 after buying an additional 203 shares in the last quarter. Institutional investors own 96.07% of the company's stock.

Regency Centers Company Profile

(

Get Free ReportRegency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to their neighborhoods, communities, and customers.

Read More

Before you consider Regency Centers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regency Centers wasn't on the list.

While Regency Centers currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.